Public Storage (PSA) Tops Q2 FFO Estimates on Higher Rents

Public Storage's PSA second-quarter 2022 core funds from operations (FFO) per share of $3.99 surpassed the Zacks Consensus Estimate of $3.92. The figure also increased 26.7% year over year.

Quarterly revenues of $1.03 billion exceeded the Zacks Consensus Estimate of $1.02 billion. Moreover, revenues increased 24.45% year over year.

Results reflect an improvement in the realized annual rent per available square foot in the reported quarter. The company also benefited from its expansion efforts through acquisitions, developments and extensions.

According to Joe Russell, president and chief executive officer, “Public Storage’s operating strength was evident during the quarter, with strong performance across the same store and non-same store portfolios driving an increase in our outlook for the back half of the year.”

Behind the Headlines

Public Storage’s same-store revenues increased 15.9% year over year to $788.9 million in the second quarter, highlighting the higher realized annual rent per available square foot. This REIT experienced a 15.7% increase in the realized annual rental income per available square foot to $20.47. However, the weighted-average square foot occupancy of 95.8% was down 1.2% year over year.

The same-store cost of operations increased 7.6% year over year, mainly reflecting an increase in the property tax expense, the on-site property manager payroll expense, the marketing expense, other direct property costs and centralized management costs.

Consequently, PSA’s same-store net operating income (“NOI”) increased 18.7% to $608.6 million. Also, this REIT’s NOI growth from non-same-store facilities was $65.2 million due to the facilities acquired in 2021 and the fill-up of recently developed and expanded facilities.

Public Storage achieved an 80.6% same-store direct NOI margin for the quarter, reflecting an increase of 1.6% year over year.

Portfolio Activity

In the June-end quarter, Public Storage acquired 10 self-storage facilities comprising 0.7 million net rentable square feet of area for $123.6 million. Following Jun 30, 2022, the company acquired or was under contract to acquire 24 self-storage facilities spanning 1.7 million net rentable square feet of space across 10 states for $257.4 million.

In the second quarter, this REIT completed several expansion projects with 0.3 million net rentable square feet and costing $36.9 million. Finally, as of Jun 30, 2022, PSA had several facilities in development (2.6 million net rentable square feet) with an estimated cost of $480.3 million and expansion projects (2.8 million net rentable square feet) worth $547.0 million. It expects to incur the remaining $647.3 million of development costs related to these projects, mainly over the next 18 to 24 months.

Balance Sheet Position

Public Storage exited the second quarter of 2022 with $1.01 billion of cash and equivalents, up from the $734.6 million recorded at the end of 2021.

Guidance

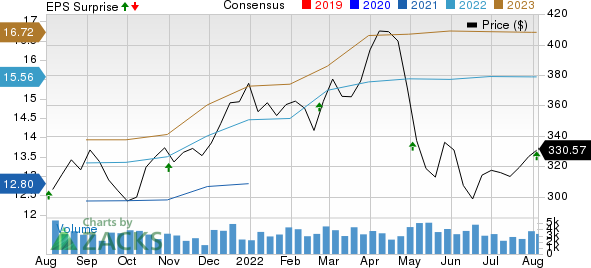

For 2022, Public Storage now projects core FFO per share in the range of $15.00-$15.70 compared with the prior guidance in the band of $14.75-$15.65. The Zacks Consensus Estimate for the same stands at $15.56.

The company’s full-year assumption is backed by 12-15% growth in same-store revenues, a 6% to 8% rise in same-store expenses and a 13.4% to 18.0% expansion in same-store NOI. Further, the company expects $1 billion of acquisitions and $250 million of development openings.

PSA’s guidance includes estimates for the impact of the sale of its investment in PS Business Parks to Blackstone on Jul 20, 2022.

Dividend Update

On Aug 3, 2022, the company’s board announced a regular quarterly dividend of $2 per common share. The dividend will be paid out on Sep 29 to shareholders of record as of Sep 14, 2022.

Public Storage currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Public Storage Price, Consensus and EPS Surprise

Public Storage price-consensus-eps-surprise-chart | Public Storage Quote

Performance of a Few REITs

Realty Income Corporation’s O second-quarter 2022 adjusted FFO per share of 97 cents surpassed the Zacks Consensus Estimate of 95 cents. The reported figure also compared favorably with the prior-year quarter’s 88 cents. The normalized FFO per share came in at $1.02 for the second quarter, up from the 88 cents reported in the year-ago period. Realty Income’s results reflected better-than-expected revenues for the quarter. The company benefited from expansionary effects and a healthy pipeline of opportunities globally. Moreover, with more than $3.2 billion invested in the first half of the year, O increased its 2022 acquisition guidance to more than $6 billion.

Extra Space Storage Inc. EXR reported second-quarter 2022 core FFO per share of $2.13, beating the Zacks Consensus Estimate of $2.04. The figure also came in 29.9% higher than the prior-year quarter’s $1.64. Extra Space Storage’s results reflected better-than-anticipated top-line growth. The same-store NOI improved year over year.

American Tower Corporation AMT reported second-quarter 2022 consolidated AFFO per share of $2.59, which surpassed the Zacks Consensus Estimate of $2.35. The bottom line improved 7% year over year. Results reflected improving revenues across its Property segment. American Tower also recorded decent year-over-year organic tenant billings growth of 2.6% and total tenant billings growth of 7.8%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Public Storage (PSA) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance