Prosperity Bancshares (PB) Rides on Buyouts Amid Strain on NIM

Prosperity Bancshares, Inc. PB remains well-poised for growth on the back of strategic buyouts, robust loans and deposits and efforts to bolster fee income. However, pressure on net interest margin (NIM) and weak mortgage income remain concerns.

PB’s organic growth strategy remains encouraging. Though the company’s net revenues dipped in 2021, 2023 and the first quarter of 2024, the metric witnessed a 7.9% compound annual growth rate (CAGR) over the last four years ended 2023. This growth was primarily driven by robust loan balances and opportunistic acquisitions alongside decent fee income performance. Further, the company’s efforts to improve its deposit mix are demonstrated through its non-interest-bearing deposits composition (35.1% of total deposits as of Mar 31, 2024). PB’s top line is likely to expand in upcoming quarters in light of a decent loan pipeline, improving deposit mix and efforts to boost fee income. Our estimates suggest total revenues to witness a CAGR of 10.1% by 2026. Further, we project total loans to grow 3.5% in 2024.

Acquisitions play a significant role in Prosperity Bancshares’ business expansion efforts. Since 1998, it has undertaken more than 30 deals. This April, the company completed the acquisition of Lone Star State Bancshares, while it acquired First Bancshares of Texas last year. These transactions are expected to be accretive to the company’s earnings. Management remains actively engaged in the pursuit of acquisitions in order to grow inorganically given a strong balance sheet.

As of Mar 31, 2024, Prosperity Bancshares’ other borrowings were $3.9 billion and cash and due from banks were $1.1 billion. The company has been running its securities book down to carry out repayment initiatives to reduce the debt strains. Amid the debt payoff initiatives and decent earnings strength, the company is likely to be able to address its debt obligations, even in the event of economic deterioration.

Nonetheless, pressure on margins remains a major headwind for Prosperity Bancshares. The company’s NIM contracted to 2.78% in 2023 from 3% in 2022 due to its liability-sensitive balance sheet. The downtrend persisted in the first quarter of 2024 on a year-over-year basis. Though asset repricing, the Lone Star acquisition and probable rate cuts may offer support to some extent, improvement in NIM is likely to be marginal amid the rising funding cost in a high interest rate environment. Our estimates suggest the metric to be 2.92% in 2024.

Uncertainty regarding PB’s mortgage banking business growth prospects is another concern. High mortgage rates have been negatively impacting mortgage origination volumes and refinancing activities. Thus, the company’s mortgage income declined in 2021 and 2022. While the trend reversed in 2023 and the first quarter of 2024 on the back of a strong pipeline, softening mortgage loan demand is likely to hurt the performance of the mortgage banking business. Though we project mortgage income to be $3.1 million (jumping 34.2%) this year, it is unlikely to reach 2020 and 2021 levels anytime soon.

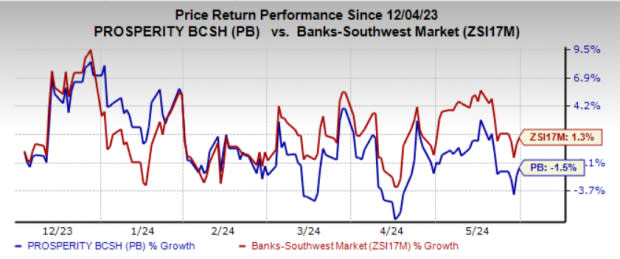

Prosperity Bancshares currently carries a Zacks Rank #3 (Hold). Over the past six months, shares of the company have lost 1.5% against the industry’s growth of 1.3%.

Image Source: Zacks Investment Research

Banking Stocks Worth Considering

Some better-ranked banks worth a look are FB Financial Corporation FBK and Merchants Bancorp, MBIN, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

The Zacks Consensus Estimate for FBK’s current-year earnings has been revised 9.5% upward in the past 60 days. FB Financial’s shares have gained 2.7% over the past six months.

The Zacks Consensus Estimate for MBIN’s current-year earnings has been revised 6% north in the past 30 days. Merchants Bancorp’s shares have risen 15.5% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

FB Financial Corporation (FBK) : Free Stock Analysis Report

Merchants Bancorp (MBIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance