Property investors are an endangered species, despite the rise in lending

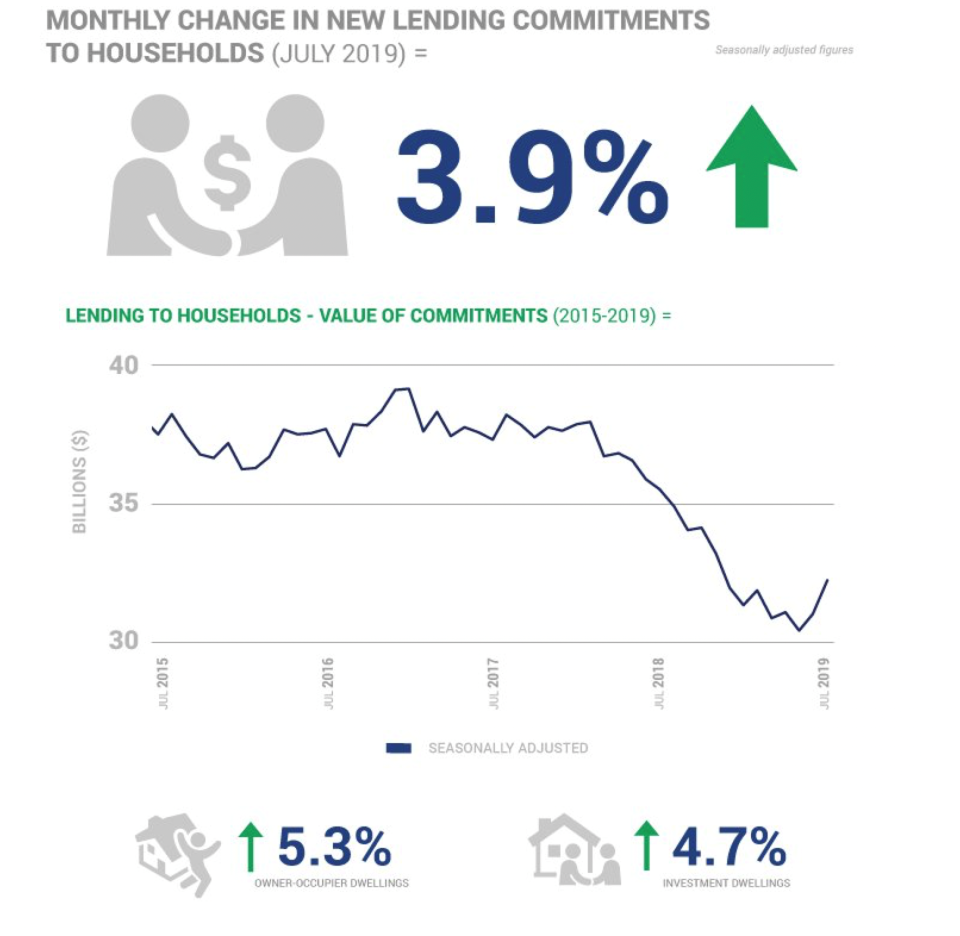

Historically low interest rates and looser bank lending restrictions have spurred the fastest rise in mortgage lending in five years.

The media has been full of news about this with many commentators excited by that fact that new loans approved surged in July by 4 per cent after the Reserve Bank cut interest rates twice.

Others warn of the property price growth risks reinflating a “dangerous property bubble.”

More from Michael Yardney: Will our lower GDP lead to a recession?

More from Michael Yardney: 6 reasons our housing market will not crash

More from Michael Yardney: How property investors develop financial freedom

To understand what’s really going on and how this could affect our property markets, let’s chat with Australia’s leading housing economist Dr. Andrew Wilson, chief economist of MyHousingMarket.com.au.

Finance approvals rebound

In only two months the value of home lending to owner-occupiers has jumped by almost 10 per cent.

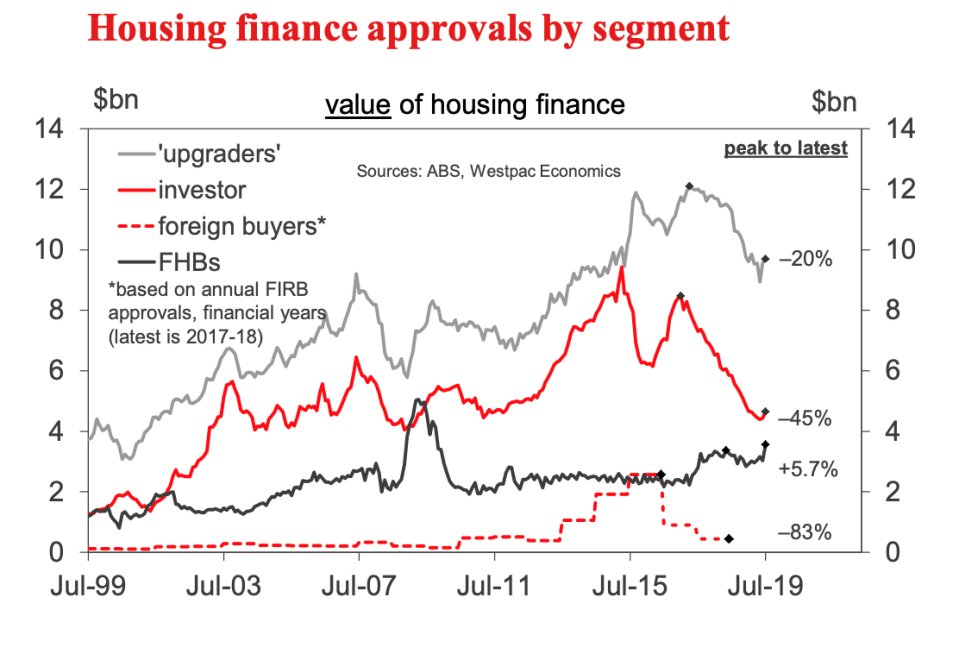

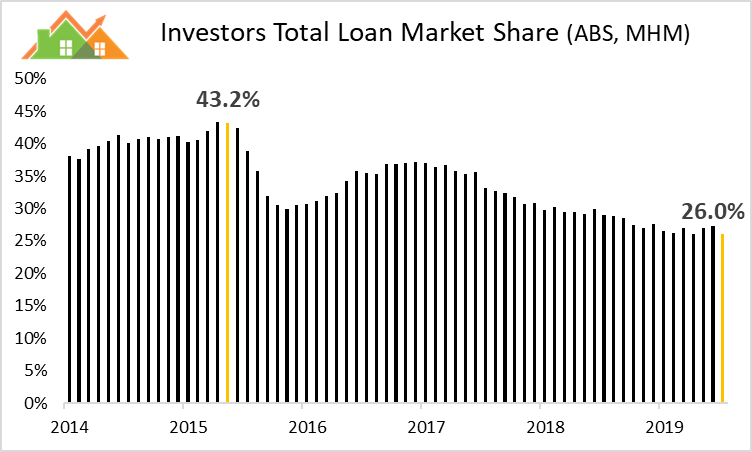

Investors are coming back into the market too, with the value of lending to property investors up by 4.7 per cent in July, after a protracted squeeze. However, as a share of the market, investors make up just 26 per cent compared to the 43 per cent share seen in 2015.

And first homebuyers are also joining the party, even ahead of the First Homebuyer Deposit Scheme from 1 January.

These figures seem to suggest that the combination of increased confidence after the re-election of the Morrison government, two interest rate drops and APRA’s loosening approach to investor mortgage lending are having the desired effects.

But remember, these recently released figures are for July and the market has moved on considerably since then with growth in buyer and seller activity around Australia resulting in higher house prices, particularly in Sydney and Melbourne.

And these figures are coming off a very low base meaning that lending is still very restrained compared to long term averages.

Investor lending

Lending to investors increased over July, up by 4.7 per cent seasonally adjusted.

But investor lending levels clearly remain in the doldrums, still down by 25.8 per cent over the past year compared to the previous year.

And investor residential loan market share remains woeful at just 25.9 per cent - the lowest for 10 years and the second lowest on record.

The low level of investor activity is one of the reasons we won’t be seeing double digit growth in property values next year as some pundits are predicting.

First Home Buyers back in town – for now

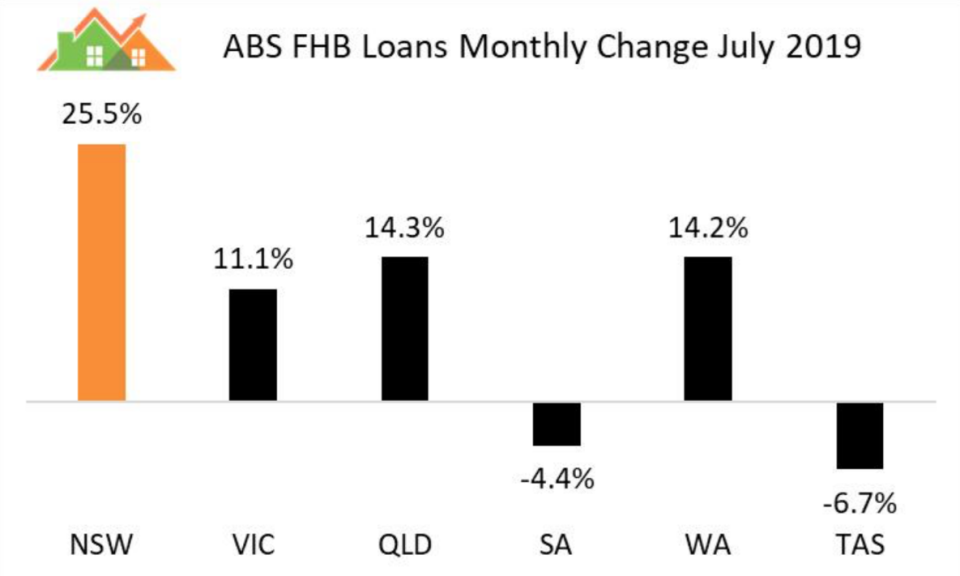

There was no surprise that first home buyers led the charge back into the market, keen to take advantage of still low property prices and relatively subdued competition from investors.

Overall total owner-occupied loans seasonally adjusted increased by 4.2 per cent over the month nationally with NSW the top performing state up by 5.4% followed by VIC up 3.4 per cent.

National first home buyer numbers however increased strongly by 15.3 per cent over the month with NSW again the state leader up 25.5%

The total residential loan market share for first home buyers is now at 19.5% - its highest level since December 2009 during the GFC FHB Boost period and well above the long-term average of 15.1 per cent.

Although higher numbers of first home buyers – and home buyers generally – can be expected over coming months, the inevitable increase in house prices - already emerging – spells bad news for first home buyers who will as usual start to struggle to keep up with their hard-earned deposit savings.

The bottom line

Our property markets are on the move and the increase in lending to both home buyers and investors is another confirmation that we’ve passed the bottom of the property cycle.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia's leading experts in wealth creation through property and writes the Property Update blog.

The Yahoo Finance’s All Markets Summit will take place on the 26th September 2019 at the Shangri-La Hotel, Sydney. Check out the full line-up of speakers and agenda here.

Yahoo Finance

Yahoo Finance