Prologis (PLD) Beats Q1 FFO Estimates on Solid Rent Growth

Prologis, Inc. PLD reported first-quarter 2023 core funds from operations (FFO) per share of $1.22, beating the Zacks Consensus Estimate of $1.21. This also compares favorably with the year-ago quarter’s figure of $1.09.

Results reflect solid demand for industrial real estate, leading to low vacancies and an increase in rents. The industrial REIT raised the midpoint of its 2023 guidance.

Highlighting the positive sentiments of investors, PLD shares are trending up during the initial hours of today’s trading session.

Prologis generated rental revenues of $1.633 billion, which surpassed the Zacks Consensus Estimate of $1.625 billion. The figure also increased from the $1.076 billion reported in the year-ago period. Total revenues were $1.77 billion, up from the year-ago quarter’s $1.22 billion.

Per Hamid R. Moghadam, the co-founder and chief executive officer of the company, " Given the macroenvironment, we continue to operate our business with a degree of caution. We foresee any potential impact on demand as likely to overlap with a deceleration in new deliveries, sustaining momentum with favorable conditions for high occupancy and continued rent growth into 2024."

Quarter in Detail

The average occupancy level in Prologis’ owned and managed portfolio was 98.0% in the first quarter. In the quarter under review, 49.7 million square feet of leases commenced in the company’s owned and managed portfolio, with 41.6 million square feet in the operating portfolio and 8.1 million square feet in the development portfolio. The retention level was 77.2% in the quarter.

Prologis’ share of net effective rent change was 68.8% in the January-March quarter. This marked an all-time high and was led by the United States at 78.8%. The cash rent change of 41.9% also represented an all-time high. Consequently, cash same-store net operating income (NOI) grew 11.4% and denoted an all-time high.

The company’s share of building acquisitions amounted to $6 million in the reported quarter. Development stabilization aggregated $770 million, while development starts totaled $57 million, with 100% being build to suit. PLD’s total dispositions and contributions were $59 million.

Liquidity

Prologis exited the first quarter of 2023 with cash and cash equivalents of $522.5 million, up from $278.5 million at the end of 2022.

Debt, as a percentage of the total market capitalization, was 19.1%. The company's weighted average interest rate on its share of the total debt was 2.6%, with a weighted average term of 9.7 years. Prologis and its co-investment ventures issued $3.6 billion of debt in the first quarter at a weighted average interest rate of 4.5%%, with a weighted average term of 13.7 years.

Per Timothy D. Arndt, the chief financial officer of Prologis, "Our liquidity position of $6.7 billion, inclusive of $1.0 billion of additional line of credit capacity closed in April, is at an all-time high, providing further flexibility to capitalize as opportunities arise."

Guidance

Prologis slightly raised its 2023 core FFO per share guidance to the range of $5.42-$5.50 from the $5.40-$5.50 guided earlier, suggesting a 0.2% increase at the midpoint. The Zacks Consensus Estimate for the same is currently pegged at $5.50.

The company expects average occupancy in the band of 97.00-97.50%, up 25 basis points (bps) at the midpoint from the prior guidance. Cash same-store NOI (Prologis share) is projected at 9.00-9.75%, up 37.5 bps at the midpoint than what was guided earlier.

Prologis currently carries a Zacks Rank #3 (Hold).

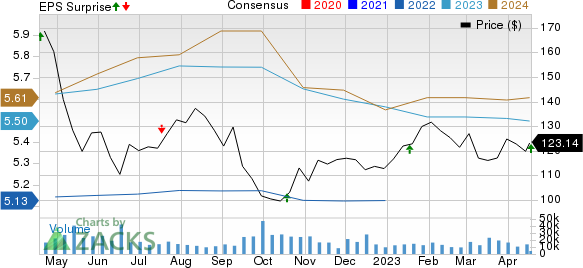

Prologis, Inc. Price, Consensus and EPS Surprise

Prologis, Inc. price-consensus-eps-surprise-chart | Prologis, Inc. Quote

Upcoming Earnings Releases

We now look forward to the earnings releases of other REITs like Crown Castle Inc. CCI and Alexandria Real Estate Equities ARE, which are slated to report on Apr 19 and Apr 24, respectively. Meanwhile, Boston Properties BXP is scheduled on Apr 25.

The Zacks Consensus Estimate for Crown Castle’s first-quarter 2023 FFO per share stands at $1.94, indicating a year-over-year increase of 3.7%. CCI currently has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Alexandria’s first-quarter 2023 FFO per share is pegged at $2.15, implying a year-over-year increase of 4.9%. ARE currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for Boston Properties’ first-quarter 2023 FFO per share is pegged at $1.70, suggesting a year-over-year fall of 6.6%. BXP currently has a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

Crown Castle Inc. (CCI) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance