Progressive (PGR) Q1 Earnings Miss, Revenues Top Estimates

The Progressive Corporation’s PGR first-quarter 2023 earnings per share of 65 cents missed the Zacks Consensus Estimate of $1.44 as well as our estimate of $1.50. The bottom line declined 20.7% year over year.

Shares lost 4.4% in the pre-market trading session, reflecting the earnings underperformance.

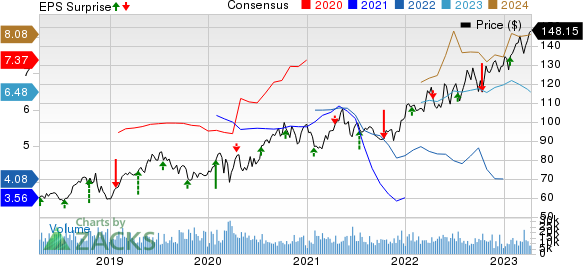

The Progressive Corporation Price, Consensus and EPS Surprise

The Progressive Corporation price-consensus-eps-surprise-chart | The Progressive Corporation Quote

Behind the Headlines

Net premiums written were $16.1 billion in the quarter, rising 22% from $13.2 billion a year ago and beating our estimate of $14.6 billion.

Net premiums earned grew 15% to $13.5 billion and beat our estimate of $12.6 billion.

Net realized gains on securities were $71.8 billion compared with a gain of $445.3 million in the year-ago quarter.

Operating revenues were about $14.2 billion, up 15.8% year over year. This improvement was driven by a 15% increase in premiums, 18.5% higher fees and other revenues, a 7.1% increase in service revenues and 73.2% higher investment income. The top line exceeded the Zacks Consensus Estimate of $14.1 billion and our estimate of $13.1 billion.

Total expenses increased 20% year over year to $13.7 billion due to 20% higher losses and loss adjustment expenses, 16% higher policy acquisition costs and a 23% rise in other underwriting expenses. Our estimate was $12 billion.

The combined ratio — the percentage of premiums paid out as claims and expenses — deteriorated 450 basis points (bps) from the prior-year quarter’s level to 99.

March Policies in Force

Policies in force were solid in the Personal Auto segment, increasing 11% from the year-ago month’s figure to 19.2 million. Special Lines improved 5% to 5.6 million.

In Progressive’s Personal Auto segment, Direct Auto increased 15% year over year to 11 million, while Agency Auto increased 5% to 8.2 million.

Progressive’s Commercial Auto segment rose 7% year over year to 1.1 million. The Property business had 2.9 million policies in force, up 4%.

Financial Update

Progressive’s book value per share was $26.32 as of Mar 31, 2023, down 1.2% from $28.31 on Mar 31, 2022.

Return on equity in March 2023 was 0.1%, down 200 basis points (bps) year over year. The total debt-to-total capital ratio deteriorated 30 bps to 27.5.

Zacks Rank

Progressive currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

W.R. Berkley Corporation WRB will report first-quarter 2023 earnings on Apr 20. The Zacks Consensus Estimate for the first quarter is pegged at $1.20, suggesting an increase of 9.1% from the year-ago quarter’s reported figure.

WRB’s bottom line beat estimates in the last four quarters.

The Travelers Companies, Inc. TRV will report first-quarter 2023 earnings on Apr 19. The Zacks Consensus Estimate for the first quarter is pegged at $3.74, suggesting a decrease of 11.4% from the year-ago quarter’s reported figure.

TRV’s bottom line beat estimates in the last four quarters.

RLI Corporation RLI will report first-quarter 2023 earnings on Apr 19. The Zacks Consensus Estimate for the first quarter is pegged at $1.21, suggesting a decrease of 15.4% from the year-ago quarter’s reported figure.

RLI’s bottom line beat estimates in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance