Will Production Gains Drive Chevron's (CVX) Q3 Earnings?

Chevron Corporation CVX is set to release third-quarter 2019 results before the opening bell on Friday, Nov 1. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $1.51 per share on revenues of $39.4 billion.

The Zacks Consensus Estimate for third-quarter earnings has been revised downward 15.2% in the past 30 days. Given this backdrop, let’s delve into the factors that might have influenced the company’s performance in the September quarter.

Factors to Consider This Quarter

Chevron’s third-quarter bottom line is likely to have benefited from production growth. In the second quarter, the integrated behemoth’s total output of crude oil and natural gas increased more than 9% compared with last year’s corresponding period to a record 3,084 thousand oil-equivalent barrels per day (MBOE/d).

The trend most likely continued in the third quarter because of higher production from shale assets in the prolific Permian Basin, contribution from Chevron’s Gulf of Mexico deepwater projects and the Wheatstone LNG development in Australia. Consequently, the Zacks Consensus Estimate for third-quarter production is pegged at 3,105 MBOE/d, indicating an increase of 5% from the year-ago reported figure.

However, the positive effect of production gain was likely offset by lower realized commodity prices. According to the U.S. Energy Information Administration, WTI prices started the third quarter of 2018 around $74 per barrel and exited the period at $73 per barrel. This year, prices started the third quarter at $59 a barrel and fell to $55 at the end of September. The year-over-year fall in realizations has most likely impacted Chevron’s upstream earnings and cash flows.

Regarding Chevron’s downstream unit, the Zacks Consensus Estimate for the to-be-reported quarter’s refinery input is pegged at 1,742 thousand barrels per day (mbpd), pointing to a rise from the year-ago level of 1,625 mbpd. This is likely to have buoyed the downstream segment’s results.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Chevron is likely to beat estimates in the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company stands at -3.13%.

Zacks Rank: Chevron has a Zacks Rank of 3.

Highlights of Q2 Earnings & Surprise History

In the last reported quarter, the San Ramon, CA-based supermajor beat the consensus mark on record production. The energy major’s results were also positively impacted by a fee it received for the failed merger attempt with Texas-based upstream company Anadarko Petroleum Corp. Chevron reported earnings per share of $2.27 that surpassed the Zacks Consensus Estimate by 53 cents.

However, quarterly revenues of $38.9 billion missed the Zacks Consensus Estimate of $41.7 billion on lower oil and natural gas price realizations.

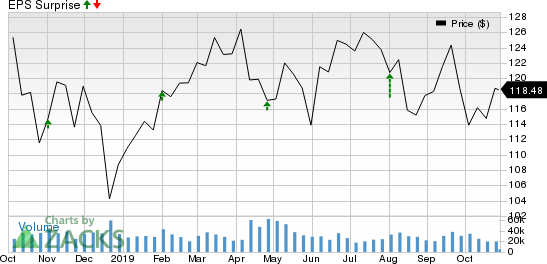

As far as earnings surprises are concerned, America's No. 2 energy producer behind ExxonMobil XOM is on an excellent footing, having gone past the Zacks Consensus Estimate in each of the last four reports. This is depicted in the graph below:

Stocks to Consider

While earnings beat looks uncertain for Chevron, here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this season:

Continental Resources, Inc. CLR has an Earnings ESP of +4.60% and is Zacks #3 Ranked. The company is scheduled to release earnings on Oct 30.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gulfport Energy Corporation GPOR has an Earnings ESP of +3.57% and a Zacks Rank #3. The company is scheduled to release earnings on Oct 31.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Click to get this free report Chevron Corporation (CVX) : Free Stock Analysis Report Exxon Mobil Corporation (XOM) : Free Stock Analysis Report Continental Resources, Inc. (CLR) : Free Stock Analysis Report Gulfport Energy Corporation (GPOR) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance