PriceSmart (PSMT) Q4 Earnings & Revenues Rise (Revised)

PriceSmart, Inc. PSMT delivered fourth-quarter fiscal 2019 results, wherein the top and bottom lines increased year over year. Moreover, comparable net merchandise sales (comps) increased despite foreign currency headwinds.

The company reported quarterly earnings of 67 cents a share, up 8.1% from unadjusted figure of 62 cents in the year-ago period.

The prior-year quarterly figure includes the adverse impact of 15 cents a share pertaining to the results of operations and costs associated with the acquisition of Aeropost. It also excluded the favorable impact of 6 cents a share related to U.S. tax reform. Considering these, the prior-year adjusted figure would have been 71 cents a share, as we had originally determined

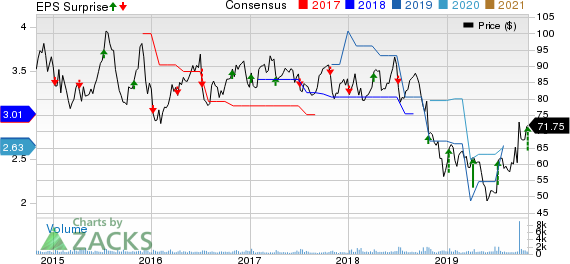

PriceSmart, Inc. Price, Consensus and EPS Surprise

PriceSmart, Inc. price-consensus-eps-surprise-chart | PriceSmart, Inc. Quote

Total revenues grew 3% to $801.3 million from $777.9 million in the prior-year quarter. Net merchandise sales rose 3.7% to $768.9 million, including adverse currency impacts of about 2.7%. While export sales declined 42.3% to $7.7 million, membership income increased 4.2% to $13.4 million. Other revenues and income came in at $11.3 million compared with $10.3 million in the year-ago quarter.

Comparable net merchandise sales for the 41 warehouse clubs increased 1.5%. The metric was adversely impacted by currency rate fluctuations to the tune of $19.9 million or 2.7%.

Warehouse club and other operations expenses came in at $79.7 million, up 8% from the year-ago quarter.

General and administrative expenses decreased 2.8% to roughly $24.6 million. Pre-opening expenses came in at $967,000, up from $50,000 in the year-ago quarter.

Other Financial Aspects

PriceSmart, which operates 43 warehouse clubs, ended the quarter with cash and cash equivalents of $102.7 million and long-term debt (including current portion) of $89.6 million. The company’s shareholders’ equity was $797.4 million, excluding non-controlling interests.

Notably, shares of this operator of membership warehouse clubs have increased approximately 18% in the past three months against the industry’s growth of 11.4%.

3 Key Picks

Burlington Stores, Inc BURL currently has a long-term earnings growth rate of 15.9% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar General Corporation DG, a Zacks Rank #2 (Buy) stock, has a long-term earnings growth rate of 9.6%.

Costco Wholesale Corporation COST presently has a long-term earnings growth rate of 8.5% and a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

(We are reissuing this article to correct a mistake. The original article, issued on October 30, 2019, should no longer be relied upon.)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

PriceSmart, Inc. (PSMT) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance