Price & Time: USD/CAD - Important Test Of Support Today

DailyFX.com -

Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list: Price & Time

Talking Points

August “pitchfork” continues to influence USD/CAD

Near-term cycles warns of potential rebound

Unfamiliar with Fibonacci Relationships? Learn more about themHERE

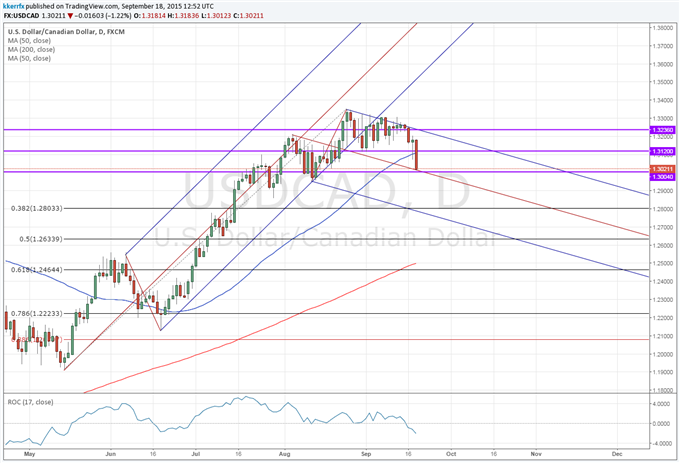

USD/CAD: Testing Gann/Median Line Convergence

A pitchfork drawn through the various key swing points in August has proven remarkably influential in USD/CAD over the past few weeks. The upper parallel, for instance, has capped all upside attempts this month outside of a couple of minor intraday spurts. These repeated failures along with a steady multi-week divergence in the three week rate-of-change have finally led to a meaningful break lower as Funds has fallen sharply today to test the August median line around 1.3015.

The 1.3015 area also roughly coincides with the 3rd square root relationship of the year’s high so this price point looks fairly critical in a near-term sense. A clear break below this level is obviously needed to set off a more serious correction towards 1.2800, while a successful hold would open the way for a potential recovery back to 1.3200.

Near-term time cycle analysis suggests today and the first couple of trading sessions on Monday are pretty key. In other words, if USD/CAD is going to try and turn back up then this is the right time for it to do so. An inability to turn up by Monday afternoon would be very negative in a short-term timing sense and set the stage for a more important correction over the next few weeks.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance