Price & Time: Pavlovian Weekend

DailyFX.com -

Talking Points

EUR/USD cracks key support

USD/CAD probing key resistance

USD/JPY tests May breakout point

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

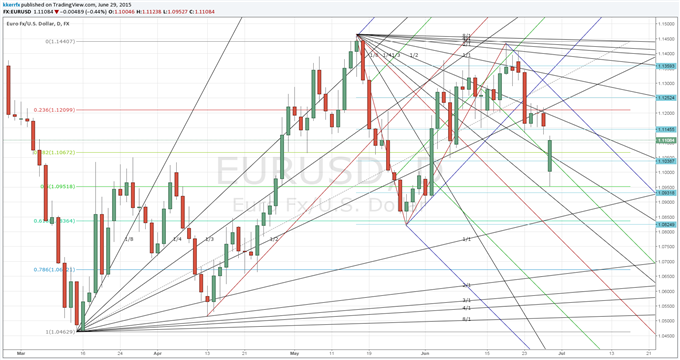

Price & Time Analysis: EUR/USD

ChartPrepared by Kristian Kerr

EUR/USD fell sharply in Aisa to trade at its lowest level in 4-weeks before finding support at a Gann level realted to the year’s low around 1.0950

Our near-term trend bias is lower in the euro while below 1.1240

Immediate focus is now on 1.0950 ahead of critical support at 1.0820

A very minor turn window is seen tomorrow

A close back over 1.1240 would turn us positive on the euro

EUR/USD Strategy: Like the short side while below 1.1240.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.0920 | 1.1040 | 123.30 | 1.1155 | *1.1240 |

Price & Time Analysis: USD/CAD

ChartPrepared by Kristian Kerr

USD/CADcontinues to consolidate below within a meidan line channel connecting the March and June highs

Our near-term trend bias is negative while below 1.2385

A close below 1.2225 is needed to re-instill downside momentum in the rate

A minor turn window is seen today/tomorrow

A daily above 1.2385 would turn us positive on USD/CAD

USD/CAD Strategy: Square

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CAD | *1.2225 | 1.2275 | 1.2340 | *1.2385 | 1.2500 |

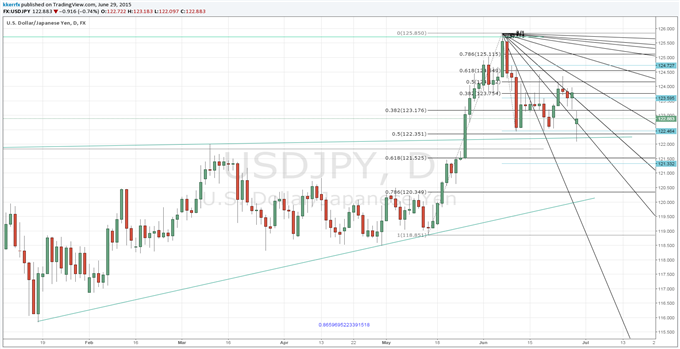

Focus Chart of the Day: USD/JPY

USD/JPY opened sharply lower in Asia and traded down to test the breakout point of the 6-month bullish consolidation pattern near 122.00 before bouncing aggressively in Pavlovian fashion as traders searched out yet another gap fill. While under the mid-June high of 124.40 there is plenty of immediate downside risk in the rate as the December/March closing highs around 121.40 and the measured move of the early June decline at 121.00 remain clear downside attractions. However, the broader technical picture is still pretty bullish following the May breakout to multi-year highs and it would probably take aggressive weakness under the trendline connecting the January/April lows around 120.50 to invalidate the medium-term positive structure in place (and trigger a more ominous false pattern breakdown scenario). Clear traction over 124.40 is needed to re-focus attention higher.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance