PPL Corp (PPL) Posts In-Line Q3 Earnings, Tightens 2019 View

PPL Corporation PPL reported third-quarter 2019 earnings per share of 61 cents, which matched the Zacks Consensus Estimate. The figure rose 3% year over year, primarily on strong operational performance from its Kentucky utilities.

On a GAAP basis, the company generated EPS of 65 cents compared with 62 cents in the year-ago quarter. The difference between GAAP and operating earnings stemmed from benefits in the U.K. Regulated segment.

Total Revenues

The company generated revenues worth $1,933 million in the third quarter, which improved 3.3% year over year from the year-ago quarter’s figure of $1,872 million.

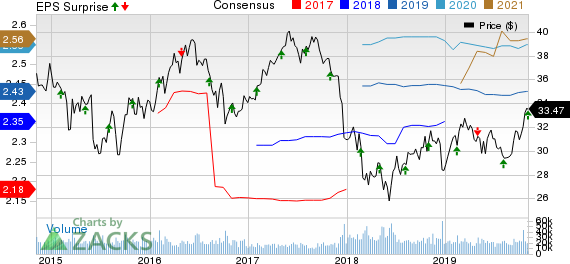

PPL Corporation Price, Consensus and EPS Surprise

PPL Corporation price-consensus-eps-surprise-chart | PPL Corporation Quote

Segment Results

U.K. Regulated: Adjusted earnings were 28 cents per share, down 2 cents from the prior-year quarter’s figure. Dilution of shares and lower sales volumes adversely impacted third-quarter earnings of the segment.

Kentucky Regulated: Adjusted earnings were 20 cents, up from 17 cents in the year-ago quarter. The upside can be primarily attributed to higher retail rates.

Pennsylvania Regulated: Adjusted earnings were 16 cents, flat year over year. The results benefited from return on additional capital investments in transmission offset by higher operation and maintenance expenses.

Corporate and Other: The segment incurred a loss of 3 cents in the quarter compared with 4 cents incurred in the year-ago quarter.

Operational Highlights

PPL Corp’s total operating expenses increased 1.8% year over year to $ 1,207 million in the quarter.

The company generated operating income of $726 million, improving 5.8% from $686 million in the prior-year quarter.

Interest expenses increased 6.2% to $259 million from the year-ago quarter’s figure of $244 million.

Financial Position

As of Sep 30, 2019, the company had cash and cash equivalents of $670 million compared with $621 million as of Dec 31, 2018.

Long-term debt (excluding debts due within a year) was $21,547 million as of Sep 30, 2019 compared with $20,069 million as of Dec 31, 2018.

Net cash flow from operating activities in the first nine months of 2019 was $1,888 million compared with $2,210 million in the year-ago period.

Guidance

PPL Corp tightened its earnings per share guidance for 2019. The company now expects earnings in the range of $2.35-$2.45 per share compared with the earlier range of $2.30-$2.50. The midpoint of the new earnings guidance is $2.40. The projected figure is lower than the current Zacks Consensus Estimate of $2.43.

Zacks Rank

Currently, PPL Corp carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Dominion Energy D reported third-quarter 2019 operating earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

Entergy ETR reported third-quarter 2019 adjusted earnings of $2.52 per share, which surpassed the Zacks Consensus Estimate of $2.31 by 9.1%.

Public Service Enterprise PEG reported third-quarter 2019 adjusted operating earnings of 98 cents per share, which beat the Zacks Consensus Estimate of 95 cents by 3.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

PPL Corporation (PPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance