PPL Corp (PPL) to Post Q3 Earnings: Is a Beat in Store?

PPL Corporation PPL is set to release third-quarter 2019 results on Nov 5, before market open. Notably, the company delivered an average positive earnings surprise of 2.74% in the last four quarters.

What Does the Zacks Model Say

Our proven model predicts an earnings beat for PPL Corp this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: The company’s Earnings ESP is +1.37%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, PPL Corp carries a Zacks Rank #3.

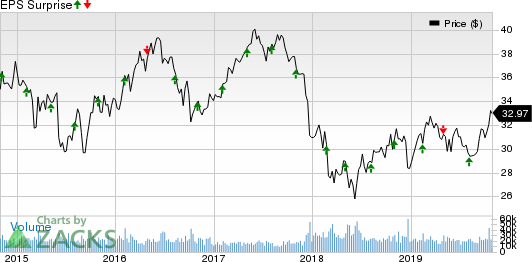

PPL Corporation Price and EPS Surprise

PPL Corporation price-eps-surprise | PPL Corporation Quote

Factors to Consider

Higher base rates, effective from May, 2019, are likely to have boosted PPL Corp’s third-quarter performance. Moreover, 100%-hedged foreign currency for 2019 ensures stable earnings, which is expected to have benefited the company in the third quarter.

Apart from focusing on customers, the company keeps investing in infrastructure to improve service quality. It has the ability to recover nearly 80% of its investments within 12 months. This factor is expected to have made a positive impact on the company in to-be-reported quarter.

Q3 Estimates

The Zacks Consensus Estimate for second-quarter earnings is pegged at 61 cents, which indicates rise of 3.39% year over year.

Other Stocks to Consider

Investors can consider the following players from the same industry that also have the right combination of elements to post an earnings beat in the to-be-reported quarter.

Eversource Energy ES is slated to release third-quarter 2019 results on Nov 6. It has an Earnings ESP of +1.06% and a Zacks Rank #2.

Exelon Corporation EXC is set to release third-quarter 2019 numbers on Oct 31. It has an Earnings ESP of +0.06% and carries a Zacks Rank #3.

PNM Resources, Inc PNM is scheduled to release third-quarter 2019 results on Nov 1. It has an Earnings ESP of +1.99% and a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PNM Resources, Inc. (Holding Co.) (PNM) : Free Stock Analysis Report

PPL Corporation (PPL) : Free Stock Analysis Report

Exelon Corporation (EXC) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance