Popular Manga App Seeks 2023 IPO in Tokyo at $6 Billion Value

(Bloomberg) -- South Korean messaging giant Kakao Corp.’s manga business is pushing back plans to go public on the Tokyo Stock Exchange until next year, aiming for a valuation of $6 billion or more.

Most Read from Bloomberg

GOP Fury Over ESG Triggers Backlash With US Pensions at Risk

A 129-Foot Superyacht Worth Millions Sinks Off the Italian Coast

Biden Unveils Plan to Free Students from ‘Unsustainable Debt’

Korea Shatters Its Own Record for World’s Lowest Fertility Rate

Six Months of Putin’s War Unravels Russia’s Superpower Image

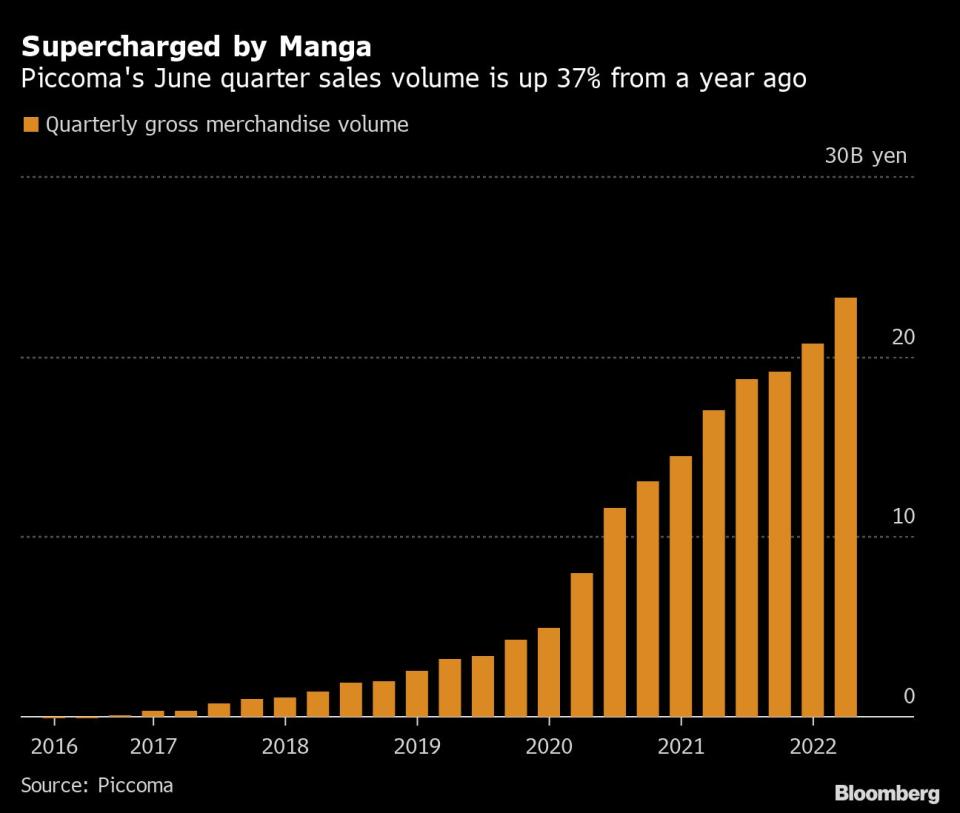

Manga app operator Kakao Piccoma Corp. had previously planned an initial public offering for this December, but is delaying the process amid slumping tech valuations, according to people familiar with the matter. Piccoma was valued at about 847 billion yen ($6.2 billion) when it raised funds last year, and the company hopes to maintain that threshold when it goes public, one of the people said. Its IPO will likely take place during the first half, but plans remain flexible and hinge on market prices, the people said.

Piccoma joins a growing pipeline of companies waiting to go public after a global stock market rout hammered tech firms with lofty multiples. Valuations for e-commerce giant Coupang Inc. -- sometimes called the Amazon of South Korea -- briefly soared to more than $86 billion last year following a $4.6 billion New York listing, only to plunge more than 60% from that peak. That’s become a cautionary tale for firms ranging from SoftBank Group Corp.’s chip architect Arm Ltd. to Kakao Entertainment Corp., which are both considering New York listings but have yet to decide on a timeline.

Piccoma, whose site features popular Japanese-style comics, can be patient because it’s already turning a profit, according to one person. Lead managers include Nomura Holdings Inc., the people said.

“It’ll be hard to get the same valuation,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management Co. Rising global interest rates and inflation will make it difficult for stocks to trade at last year’s lofty price-earnings ratios, he said. “The markets may recover, but the mechanism lifting valuations has changed.”

Piccoma plans to go public, but details of the IPO, including the timing, continue to be under review, a company representative said without elaborating.

Owned 72.9% by Kakao and 18.2% by Kakao Entertainment, Piccoma is battling Line Corp., operator of Japan’s biggest messaging platform, to be the country’s most widely-used manga app. Piccoma’s monthly readership hit a June quarter high of 9.5 million, compared with about 2 million in August 2017. That helped it rank eighth globally among non-gaming apps by monthly sales in June, according to data tracker data.ai.

The app offers the first few chapters of most cartoons for free. It charges users who want to keep on reading, while also offering the option to wait 24 hours before continuing a given cartoon without paying. The approach struck a chord with readers and helped Piccoma capture new users when it was trying to crack the Japanese market.

A digital shift in Japan’s comics market has also fueled Piccoma’s growth. Digital manga sales climbed 20% in 2021 from the previous year, growing more than fourfold in seven years and accounting for more than 60% of the total $5 billion market, according to a report published by All Japan Magazine and Book Publisher’s and Editor’s Association.

Piccoma swung to a profit for the first time in 2020, based on filings made to Korean regulators. Its net income more than tripled to $39 million in 2021 on an 88% surge in sales. The company’s net income shrank to $2 million on a 27% rise in revenue for the first half of this year, however, as higher marketing costs hit profitability.

Piccoma raised 60 billion yen in May last year from investors including Anchor Equity Partners, and the startup hopes its profitability will attract more investors at its IPO, one person said. During investor pitches, some have compared Piccoma to other firms that generate viewership-based revenue, like Netflix Inc. Piccoma’s manga app has one advantage, because its revenue per user isn’t capped at a fixed monthly fee, but can rise based on the number of chapters read, according to the person. Still, even Netflix’s stock has plunged this year as subscriptions stalled.

Piccoma’s Tokyo debut could also be a watershed moment for an increasing number of Korean startups attempting to make inroads overseas.

The operator of South Korea’s biggest messaging app KakaoTalk, parent Kakao has struggled to crack markets in Asia and elsewhere as the sprawling group ran head-first into dominant messaging apps like WeChat and Line. Piccoma, however, is betting it can use its experience in Japan to expand elsewhere. The manga app launched its service in France this March to make a play for the European audience.

“We plan to secure Piccoma’s place in the French market, and build a foundation for Kakao’s footing in global expansion,” Piccoma said in a release in July.

Most Read from Bloomberg Businessweek

A ‘Tsunami of Shutoffs’: 20 Million US Homes Are Behind on Energy Bills

How Deadly Bacteria Spread in a Similac Factory—and Caused the US Formula Shortage

SoftBank’s Epic Losses Reveal Masayoshi Son’s Broken Business Model

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance