Pool Corp (POOL) Stock Up on Q3 Earnings Beat & Upbeat View

Pool Corporation POOL reported better-than-expected third-quarter 2019 results. The bottom line beat the Zacks Consensus Estimate for the second straight quarter and the top line beat the same after missing in the preceding two quarters. Following the results, the company’s shares increased 6.1% on Oct 17.

Adjusted earnings of $1.84 per share in the quarter topped the Zacks Consensus Estimate of $1.77 and increased 16% from the year-ago quarter’s tally. Quarterly net revenues totaled $898.5 million, which surpassed the consensus mark of $887 million and improved 11% year over year. Additionally, sales increased 1% from an extra selling day in the third quarter of 2019 compared with 2018 tally.

Revenue growth can be primarily attributed to robust performance of the company’s Base business, which registered an increase of 8% year over year. Base business growth was driven by sales growth of 7% each from California, Florida and Arizona and rise of 9% from Texas. The company also witnessed strong demand from France, Germany and Spain.

Let’s discuss the quarterly numbers.

Segmental Performance

Pool Corp reports operations under two segments — The Base Business segment (constituting majority of the business) and the Excluded segment (sale centers excluded from the base business).

Revenues in the Base Business segment increased 9% year over year to $886.7 million. Also, operating income improved 13% to $104.5 million. Operating margin expanded 40 basis points (bps) from the year-ago quarter’s number.

The Excluded segment delivered net revenues of $11.8 million, up from about $0.30 million registered in the prior-year quarter. The segment reported operating loss of $0.18 million compared with the year-ago quarter’s loss of $0.06 million.

Operating Highlights & Expenses

Cost of sales in the third quarter increased 11.2% from the prior-year quarter’s figures. Gross profit, as a percentage of net sales, declined 30 bps to 28.7% from the year-ago quarter’s figure.

Operating income increased 13% year over year to $104.5 million. Also, the operating margin expanded 20 bps to 11.6% from the prior-year quarter’s level. Selling and administrative expenses too increased 7.5% year over year. Net income totaled $243.6 million, up from $217.6 million recorded in the year-ago quarter.

Adjusted EBITDA increased to $115.5 million in the quarter from $102.5 million in third-quarter 2018.

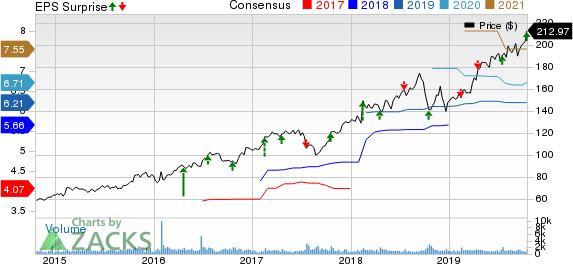

Pool Corporation Price, Consensus and EPS Surprise

Pool Corporation price-consensus-eps-surprise-chart | Pool Corporation Quote

Balance Sheet

As of Sep 30 2019, Pool Corp’s cash and cash equivalents amounted to $36.7 million compared with $35.7 million on Sep 30, 2018. Total net receivables, including pledged receivables, rose 6% and inventory levels grew 1% year over year. Its long-term debt amounted to $535.7 million, down 6% from the prior-year quarter’s level. Goodwill fell 0.5% year over year.

In the first nine months of 2019, cash provided by operations increased to $243.3 million in the quarter under review compared with $51.3 million in the prior-year quarter.

2019 Guidance

For 2019, Pool Corp expects EPS in the range of $6.20-$6.40 compared with prior guidance of $6.09-$6.34. The Zacks Consensus Estimate for current-year earnings is pegged at $6.21.

Zacks Rank & Other Key Picks

Pool Corp has a Zacks Rank #2 (Buy).

Some other top-ranked stocks that warrant a look include Acushnet Holdings Corp GOLF, Hasbro, Inc HAS and Brunswick Corporation BC. Acushnet Holdings and Hasbro sport a Zacks Rank #1 (Strong Buy), whereas Brunswick carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Acushnet Holdings has an impressive year-over-year earnings growth estimate of 14.4% in the current year.

Hasbro delivered better-than-expected earnings in two of the trailing four quarters, the average being 95.2%.

Brunswick has an impressive long-term earnings growth rate of 10%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pool Corporation (POOL) : Free Stock Analysis Report

Brunswick Corporation (BC) : Free Stock Analysis Report

Acushnet Holdings Corp. (GOLF) : Free Stock Analysis Report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance