Pioneer Natural (PXD) Q4 Earnings & Revenues Beat Estimates

Pioneer Natural Resources Company PXD reported fourth-quarter 2019 earnings per share of $2.36, excluding one-time items, beating the Zacks Consensus Estimate of $2.12. Further, the bottom line surged from the year-ago quarter’s $1.18.

Revenues and other income declined 1.3% year over year to $2,643 million from $2,677 million a year ago. However, the top line beat the consensus mark of $2,493 million.

The company reported strong quarterly earnings, thanks to higher production and average realized prices on an oil-equivalent basis.

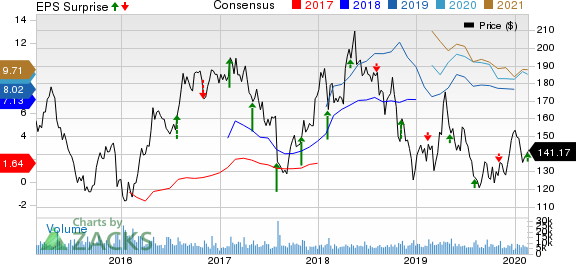

Pioneer Natural Resources Company Price, Consensus and EPS Surprise

Pioneer Natural Resources Company price-consensus-eps-surprise-chart | Pioneer Natural Resources Company Quote

Dividend Hike & Share Buyback

In a separate release, the company hiked quarterly dividend by 25% to 55 cents per share. The increased dividend is likely to be paid on Apr 14, to stockholders of record as of Mar 31.

During the December quarter of 2019, the explorer bought back $22 million of shares as part of its $2-billion repurchase program. As of Feb 19, the upstream firm repurchased $749 million worth of shares under the authorized buyback plan.

Production

Total production in the reported quarter was 363.4 thousand barrels of oil equivalent per day (MBOE/d), up 14% year over year. The upside can be attributed to strong contributions from the Permian Basin.

Oil production was 220.3 thousand barrels per day (MBbl/d), up 10.6% year over year. Natural gas liquids (NGLs) production of 80.2 MBbl/d was higher than the year-ago quarter’s 61.9 MBbl/d. Moreover, natural gas production amounted to 377.3 million cubic feet per day (MMcf/d), up from the year-ago quarter’s 351.2 MMcf/d.

Price Realization

On an oil-equivalent basis, average realized price was $40.36 per barrel in the reported quarter compared with $38.16 a year ago. The company reported average realized crude price of $56.01 a barrel, up from $49.80 in the December-end quarter of 2018.

Average natural gas price increased 26.3% year over year to $2.21 per thousand cubic feet (Mcf). However, natural gas liquids were sold at $18.60 a barrel, down from $26.88 a year ago.

Cash, Debt and Capex

At the end of the quarter under review, cash balance totaled $631 million. Long-term debt summed $1,839 million, reflecting a debt-to-capitalization ratio of 15.9%.

During the December-end quarter, the company spent $627 million for operations in the Permian Basin, which includes expenditure for gas processing and water infrastructure.

Proved Reserves

As of Dec 31, 2019, the company’s proved reserves were recorded at 1,136 million barrels of oil equivalent (MMBoE), up from a year ago’s 1,049 MMBoE.

Guidance

For 2020, the upstream energy player projects capital budget for drilling, completions and facilities in the band of $3-$3.3 billion. Total oil equivalent volumes for 2020 has been estimated in the band of 383 to 403 MBoE/D. Notably, the company expects oil production for 2020 in the range of 235 to 245 MBbl/D.

For the March-end quarter, the company projects oil production of 217-227 MBbl/D. The upstream energy firm expects total production for the quarter in the range of 361-376 MBoE/D.

Zacks Rank & Stocks to Consider

Pioneer Natural currently carries a Zacks Rank #3 (Hold). Meanwhile, a few better-ranked players in the energy sector include Denbury Resources Inc. DNR, Chevron Corporation CVX and Hess Corporation HES, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Denbury Resources’ earnings per share estimate of 30 cents for 2020 has been unchanged over the past seven days.

Chevron’s bottom line for 2020 is expected to rise 12.8% year over year.

Hess’ bottom line for 2020 is likely to increase 93.7% year over year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Denbury Resources Inc. (DNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance