Piedmont (PDM) Announces New Lease at 501 W. Church, Orlando

Piedmont Office Realty Trust PDM recently announced that Travel + Leisure Co. TNL has signed a new lease at Piedmont’s 501 W. Church building in Downtown, Orlando, for its new corporate headquarters.

Travel + Leisure, the world’s leading membership and leisure travel company, has chosen the entire five-story building encompassing approximately 182,000 square feet. The lease will run through 2040, employing nearly 900 individuals at the property.

In anticipation of the commencement of Travel + Leisure in 2025, Piedmont intends to renovate and rebrand the building. It plans to add signage and modern amenities such as a new fitness center, conference center, and café to create an office experience uniquely tailored for Travel + Leisure's employees.

Per Alex Valente, executive vice president for Piedmont’s Southeast region, “We are honored that a world-class company such as Travel + Leisure has chosen 501 W. Church for its headquarters location. We very much appreciate the collaboration and support from Mayor Dyer’s administration and the Orlando Economic Partnership to help attract the largest lease in downtown Orlando since 2019.”

During the first quarter of 2024, Piedmont completed approximately 500,000 square feet of leasing, including approximately 328,000 square feet of new tenant leasing. As of Mar 31, 2024, it had around 1.3 million square feet of executed leases for vacant space yet to commence or under rental abatement. Its healthy leasing activities are expected to boost the occupancy level at the company’s property and fuel growth in rental income.

Per a Cushman & Wakefield report, the high interest rate environment, hybrid and remote work strategies and slower office-using employment growth compared to the U.S. job market continued to keep occupiers cautious about office leasing decisions in the first quarter of 2024.

Although overall demand for office spaces in some markets is likely to remain subdued in the near term, given tenants’ healthy demand for premier office spaces with class-apart amenities, Piedmont is well-poised for growth over the long term.

With encouraging leases executed over the past few quarters, the company remains well-positioned to navigate the challenging environment. Its long-term leases with creditworthy corporate or governmental tenants assure stable rental revenues.

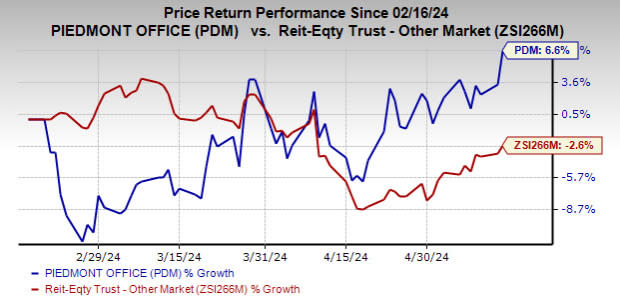

Over the past three months, shares of this Zacks Rank #3 (Hold) company have rallied 6.6% against the industry’s decline of 2.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are Healthpeak Properties DOC and SL Green Realty SLG, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for PEAK’s current-year FFO per share has moved marginally northward over the past week to $1.78.

The Zacks Consensus Estimate for SLG’s 2024 FFO per share has been raised 3.5% over the past week to $7.33.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM) : Free Stock Analysis Report

Healthpeak Properties, Inc. (DOC) : Free Stock Analysis Report

Travel + Leisure Co. (TNL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance