A Piece Of The Puzzle Missing From Matrix Composites & Engineering Ltd's (ASX:MCE) 25% Share Price Climb

Matrix Composites & Engineering Ltd (ASX:MCE) shareholders have had their patience rewarded with a 25% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 47%.

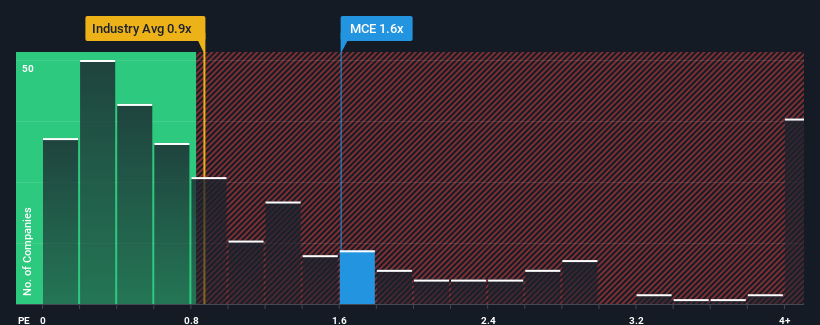

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Matrix Composites & Engineering's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in Australia is also close to 2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Matrix Composites & Engineering

How Has Matrix Composites & Engineering Performed Recently?

Matrix Composites & Engineering certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Matrix Composites & Engineering will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Matrix Composites & Engineering would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 65% last year. The strong recent performance means it was also able to grow revenue by 72% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 26% each year during the coming three years according to the only analyst following the company. That's shaping up to be materially higher than the 9.0% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Matrix Composites & Engineering's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Matrix Composites & Engineering's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Matrix Composites & Engineering's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Matrix Composites & Engineering (of which 2 are potentially serious!) you should know about.

If you're unsure about the strength of Matrix Composites & Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance