Philips (PHG) Drives Healthcare Prospects With Enhanced Dataset

Philips PHG has been benefiting from a constantly expanding healthcare portfolio.

It recently announced its expansion with MIT IMES to give researchers access to a new critical care dataset containing de-identified data of 200,000 critical care patients, including COVID-19 patients.

The updated eICU Collaborative Research Database (eICU- CRD) aims to advance machine learning and artificial intelligence in healthcare to improve patient care and clinical outcomes.

The new secure database provides comprehensive insights on treatments, co-morbidities, readmissions, and clinical outcomes.

The eICU-CRD is a dataset with detailed critical care data from over 200 US hospitals and has been used by over 3,000 users with citations in over 660 published research papers, including in top medical journals.

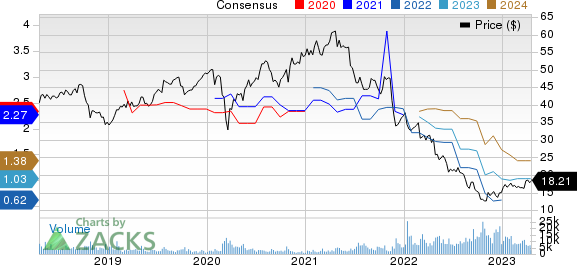

Koninklijke Philips N.V. Price and Consensus

Koninklijke Philips N.V. price-consensus-chart | Koninklijke Philips N.V. Quote

Philips’ Expanding Portfolio to Drive Top Line

Philips recently released its latest portfolio of smart diagnostic systems and transformative workflow solutions powered by AI.

Further, Philips announced that it has entered into a seven-year agreement with Northwell Health, one of the largest healthcare providers in the state of New York.

The addition of Philips’ systems to Northwell Health’s existing system aims at improving patient monitoring, care and outcomes, simultaneously driving interoperability and data innovation.

Additionally, it recently unveiled Philips Virtual Care Management, which is designed to connect health system providers, payers and employer groups, as well as patients from anywhere virtually.

Moreover, the company also entered into a strategic partnership with Gibraltar Health Authority to advance radiology and cardiology patient care at St Bernard’s Hospital.

Expanding portfolio and partner base is expected to drive top-line growth in 2023. Philips’ 2022 revenues were negatively impacted by global supply shortages, inflationary pressures, and disruptions caused by the COVID situation in China and the Russia-Ukraine war.

Philips now expects to deliver low-single-digit comparable sales growth and a high-single-digit adjusted EBITA margin in 2023, which is driven by component and pricing actions across its business.

For second-quarter fiscal 2023, the Zacks Consensus Estimate for revenues is pegged at $4.76 billion, indicating growth of 8.5% from the year-ago quarter’s reported quarter.

Moreover, the consensus mark for earnings is projected at $3.77 per share, indicating growth of 12.5% from the year-ago quarter’s reported figure.

Zacks Rank & Stocks to Consider

Currently, Philips carries a Zacks Rank #3 (Hold). It has lost 39.1% in a year compared with the Zacks Medical- Products industry’s and the Zacks Medical sector’s decline of 38.1% and 14.3%, respectively.

Some better-ranked stocks in the broader sector are Adaptive Biotechnology ADPT, Alcon ALC and Addus HomeCare ADUS, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Adaptive Biotechnology shares have lost 17% in the past year. The long-term earnings growth rate for ADPT is currently projected at 21.58%.

Alcon shares have lost 12.3% in the past year. ALC’s long-term earnings growth rate is currently projected at 14.96%.

Addus HomeCare shares have gained 18.7% in the past year. The long-term earnings growth rate for ADUS is currently projected at 11.66%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Addus HomeCare Corporation (ADUS) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance