Philip Morris International (NYSE:PM) Is Paying Out A Larger Dividend Than Last Year

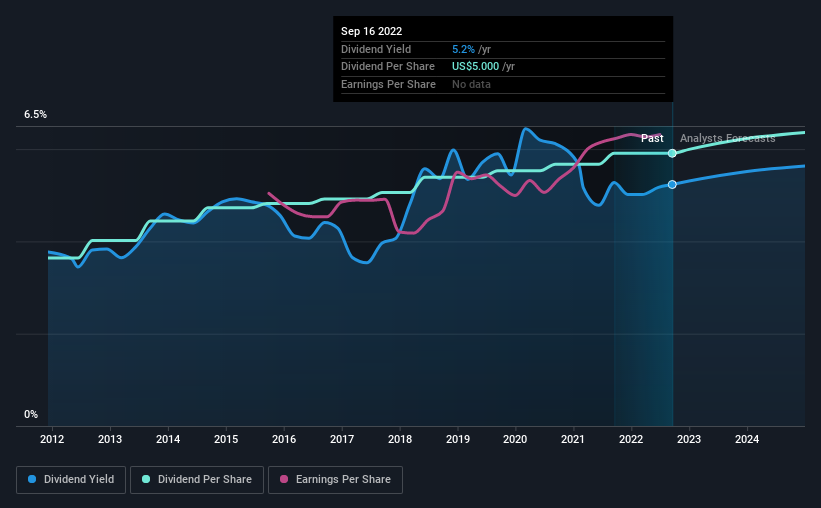

Philip Morris International Inc. (NYSE:PM) will increase its dividend on the 12th of October to $1.27, which is 1.6% higher than last year's payment from the same period of $1.25. This makes the dividend yield about the same as the industry average at 5.2%.

Check out our latest analysis for Philip Morris International

Philip Morris International's Dividend Is Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last payment made up 86% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Over the next year, EPS is forecast to expand by 11.0%. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 80% - on the higher side, but we wouldn't necessarily say this is unsustainable.

Philip Morris International Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was $3.08 in 2012, and the most recent fiscal year payment was $5.00. This implies that the company grew its distributions at a yearly rate of about 5.0% over that duration. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend Has Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that Philip Morris International has grown earnings per share at 5.3% per year over the past five years. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Philip Morris International's payments are rock solid. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Philip Morris International that you should be aware of before investing. Is Philip Morris International not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance