Pharma Stock Roundup: Pfizer Mulls Options for Consumer Healthcare, LLY's Pipeline Setback

Companies like Pfizer PFE, Merck MRK and Eli Lilly LLY were in the news this week – while Pfizer is mulling strategic options for its Consumer Healthcare business, Merck said that it will not file its CETP inhibitor.

Recap of the Week’s Most Important Stories

Pfizer to Divest Consumer Healthcare Segment? Pfizer is currently reviewing different strategic options for its Consumer Healthcare business which includes a full or partial separation via a spin off or sale. The company could also ultimately decide to retain the business. This is not the first time that Pfizer has decided to spin off or sell a non-core business segment. Some of the strategic steps taken by Pfizer include the sale of the Hospira infusion systems business to ICU Medical (February 2017), the spin-off of the animal health business that led to the creation of Zoetis (2013) as well as the divestment of the nutrition business to Nestle in 2012. Before that, Pfizer had sold off its Capsugel business to an affiliate of Kohlberg Kravis Roberts & Co.

The divestment of the Consumer Healthcare business would help Pfizer focus on its Innovative Health segment and would also bring in funds that the company could use for returning value to shareholders in the form of share buybacks and dividends (Read more: Pfizer Considering Sale/Spin-Off of Consumer Healthcare Unit).

Pfizer is a Zacks Rank #3 (Hold) stock - you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The company has gained 11.9% year to date, compared to the 18.9% rally of the industry it belongs to.

Merck Collaborates with KalVista: Clinical-stage pharma company, KalVista Pharmaceuticals saw its shares shoot up 38.6% on a collaboration agreement with Merck for KVD001 and future oral diabetic macular edema (“DME”) compounds based on plasma kallikrein inhibition.

KVD001, an investigational intravitreal (IVT) injection, is scheduled to move into a phase II proof-of-concept study later this year. Merck has the option to acquire rights to the candidate following the completion of the study. Merck has a similar option for certain other DME candidates.

KalVista will receive a non-refundable upfront payment of $37 million as well as payments associated with the exercise of the options by Merck and the achievement of milestones for each program that could add up to $715 million. The company also stands to receive tiered royalties on net sales for candidates commercialized under the deal. Merck also acquired a 9.9% ownership stake in KalVista worth $9.1 million.

Another Pipeline Setback for Lilly: Lilly suffered a setback with its recently approved breast cancer drug, Verzenio, failing to meet the primary endpoint in a late-stage study in KRAS-mutated, advanced non-small cell lung cancer. While the CDK4 and 6 inhibitor failed to meet the primary endpoint of overall survival (“OS”), an analysis of the secondary endpoints of progression-free survival (“PFS”) and overall response rate (“ORR”) showed evidence of monotherapy activity (Read more: Lilly's Verzenio Fails in Phase III Lung Cancer Study).

Meanwhile, Verzenio has been granted priority review by the FDA for use in the initial treatment of advanced breast cancer. This means a response from the agency should be out within eight months of receiving the regulatory application instead of the usual timeframe of 12 months.

J&J Seeks FDA Nod for New Prostate Cancer Treatment: Johnson & Johnson’s Janssen Biotech is seeking FDA approval for apalutamide, an investigational, next generation oral androgen receptor (“AR”) inhibitor for men with non-metastatic castration-resistant prostate cancer (“CRPC”). There is significant unmet need for this patient population given the absence of FDA approved treatments for these patients.

Prostate cancer, the most common cancer among American men, is expected to be diagnosed in more than 161,000 men in 2017, as per the American Cancer Society.

Apalutamide became a part of J&J’s pipeline following its 2013 acquisition of privately-held Aragon Pharmaceuticals. Apalutamide’s approval would strengthen and expand J&J’s presence in the prostate cancer market – the company currently sells Zytiga, which is approved for use in combination with prednisone for the treatment of patients with metastatic castration-resistant prostate cancer (“mCRPC”). J&J is looking to expand Zytiga’s label into earlier stages of metastatic prostate cancer.

Allergan Settles Restasis Litigation with InnoPharma: Allergan AGN entered into a settlement agreement with InnoPharma related to litigation regarding Restasis patents. The challenged patents are listed in the Orange Book and are scheduled to expire on Aug 27, 2024.

Under the settlement agreement, InnoPharma can start selling a generic version of the eye drug in the United States from Feb 24, 2024 or earlier under certain circumstances. Moreover, under certain circumstances, InnoPharma will be allowed to launch an authorized generic version of Restasis on Aug 28, 2024.

Allergan is adopting different ways of protecting Restasis from generic competition. The company recently came under fire for entering into an agreement with the Saint Regis Mohawk Tribe, with lawmakers questioning the unconventional move adopted by the company to protect the blockbuster eye drug from generic competition. Restasis is Allergan’s second best-selling drug bringing in sales of almost $1.5 billion in 2016. Lawmakers pointed out that the sovereign status of Native American tribes would make any patent challenges lengthy and complex as tribes may be immune from the legal claims made by generic drug makers to challenge patents. In fact, the Tribe is filing to dismiss the ongoing inter partes review (“IPR”) of the Restasis patents based on their sovereign immunity from IPR challenges.

The deal with the Tribe has basically raised concerns that it will curb generic competition in the pharmaceutical industry and discourage generic drugmakers from making cheaper copy-cat versions of expensive drugs. Allergan has been asked by the Committee on Oversight and Government Reform to provide certain documents and information about the deal by Oct 17, 2017.

Merck Will Not File Anacetrapib: Merck has decided that it will not seek regulatory approval for its investigational CETP inhibitor, anacetrapib. The company’s decision was based on a thorough review of the clinical profile of the drug. We note that Merck is not the first company to drop a CETP inhibitor from its plans. Companies like Lilly, Roche and Pfizer have all had high profile setbacks with their CETP inhibitors and the class was more or less written off (Read more: Merck Will Not Seek Approval for CETP Inhibitor Anacetrapib).

CRL for AcelRx’s Dsuvia: AcelRx Pharmaceuticals’s ACRX shares plunged 59.8% with the company getting a Complete Response Letter (“CRL”) from the FDA for Dsuvia (sufentanil sublingual tablet). The FDA said that it cannot approve the regulatory application in its current form and has asked for additional safety data. The agency has also asked the company to make certain changes to the Directions for Use to ensure the proper administration of the tablet. AcelRx has been asked to validate the same through a human factors study. AcelRx is looking to get Dsuvia approved for the reduction of moderate-to-severe acute pain and dosing errors associated with IV administration via its non-invasive single-dose applicator (“SDA”) in medically supervised settings.

Performance

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

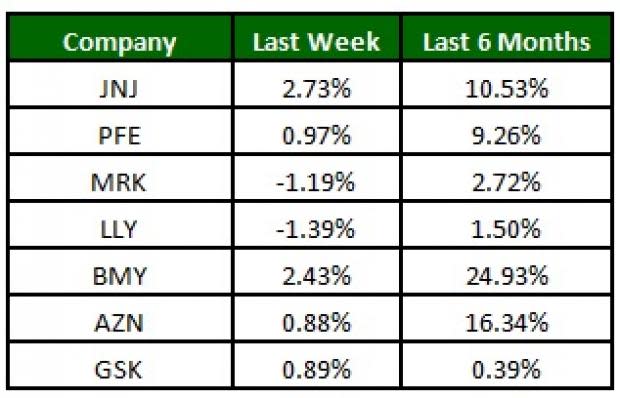

The NYSE ARCA Pharmaceutical Index gained 0.5% this week. Among major stocks, J&J is up 2.7% while Lilly declined 1.4%. Over the last six months, Bristol-Myers Squibb BMY was up 24.9% (See the last pharma stock roundup here: Mylan Up, Teva Down on Copaxone News, Lawmakers Question Allergan Deal).

What's Next in the Pharma World?

Aerie Pharmaceuticals’s AERI Rhopressa will be evaluated by an FDA advisory panel for the treatment of patients with open-angle glaucoma or ocular hypertension on October 13. The company’s shares were up on favorable briefing documents.

J&J will be reporting Q3 earnings on October 17 (Read more: J&J to Kickstart Pharma Q3 Earnings: What's in Store?).

4 Stocks to Watch after the Massive Equifax Hack

Cybersecurity stocks spiked on recent news of a data breach affecting 143 million Americans. But which stocks are the best buy candidates right now? And what does the future hold for the cybersecurity industry?

Equifax is just the most recent victim. Computer hacking and identity theft are more common than ever. Zacks has just released Cybersecurity! An Investor’s Guide to inform Zacks.com readers about this $170 billion/year space. More importantly, it highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol-Myers Squibb Company (BMY) : Free Stock Analysis Report

Pfizer, Inc. (PFE) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Allergan PLC. (AGN) : Free Stock Analysis Report

Merck & Company, Inc. (MRK) : Free Stock Analysis Report

AcelRx Pharmaceuticals, Inc. (ACRX) : Free Stock Analysis Report

Aerie Pharmaceuticals, Inc. (AERI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance