Pfizer (PFE) 2nd Ulcerative Colitis Study on Etrasimod Succeeds

Pfizer’s PFE year-long phase III study evaluating pipeline candidate, etrasimod, for the treatment of moderately to severely active ulcerative colitis (UC) met primary and key secondary endpoints. UC is a chronic inflammatory bowel disease.

In the ELEVATE UC 52 study, patients treated with etrasimod (2 mg once daily) achieved statistically significant improvements in the co-primary endpoints of clinical remission at weeks 12 and 52 compared to placebo. The secondary endpoints of the study were also met with statistical significance at both 12 and 52 weeks. The safety profile of etrasimod in the study was consistent with previous studies. The 433 UC patients enrolled in the study had previously failed or were intolerant to at least one conventional, biologic, or JAK therapy.

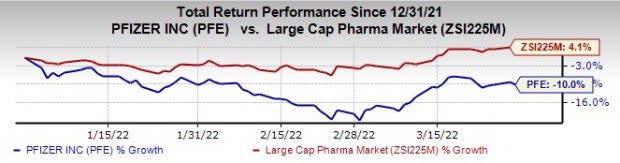

Pfizer’s stock is down 10.0% this year so far against an increase of 4.1% for the industry.

Image Source: Zacks Investment Research

ELEVATE UC 52 is the second phase III study on etrasimod, an oral, once-a-day, selective sphingosine 1-phosphate (S1P) receptor modulator, for UC to have met primary and key secondary endpoints.

Positive 12-week data from the first study ELEVATE 12 study were announced last week. The data showed that patients treated with etrasimod (2 mg once daily) achieved statistically significant improvements in the primary endpoint of clinical remission at week 12 compared with placebo. The secondary endpoints of the study were also met with statistical significance.

Data from ELEVATE 12 and ELEVATE 52 studies and their long-term extension studies will now form the basis of the regulatory submissions expected later this year

Apart from UC, etrasimod is being studied across multiple gastroenterology and dermatology indications, including atopic dermatitis (AD), eosinophilic esophagitis, Crohn’s disease (CD) and alopecia areata.

Etrasimod was added to Pfizer’s pipeline following its recent acquisition of Arena Pharmaceuticals for $6.7 billion. Other than etrasimod, the acquisition added two mid-stage candidates, namely APD418 and temanogrel, to Pfizer’s pipeline, which are being developed as treatments for cardiovascular disorders.

Zacks Rank and Stocks to Consider

Pfizer has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the biotech sector are Vertex Pharmaceuticals Incorporated VRTX, Voyager Therapeutics VYGR and Gamida Cell GMDA, each carrying a Zacks Rank #2 (Buy).

Vertex Pharmaceuticals’ stock has risen 17.5% this year. Estimates for Vertex Pharmaceuticals’ 2022 earnings have gone up from $13.35 to $14.52 per share, while that for 2023 has increased from $15.29 to $15.31 per share over the past 60 days.

Vertex Pharmaceuticals’ earnings performance has been strong, with the company beating earnings expectations in each of the last four quarters. Vertex Pharmaceuticals pulled off a four-quarter earnings surprise of 10.01%, on average.

Voyager Therapeutics’ loss estimates narrowed from $2.20 per share to $1.35 per share for 2022 and from $1.93 per share to $1.37 per share for 2023 in the past 60 days. Voyager Therapeutics’ stock is up 179.3% this year so far.

Voyager Therapeutics’ earnings performance has been decent, with the company beating earnings expectations in three of the last four quarters while missing in one. Voyager Therapeutics pulled off a four-quarter earnings surprise of 41.0%, on average.

Estimates for Gamida Cell’s 2022 bottom line has narrowed from a loss of $1.83 to $1.18 per share, while that for 2024 has narrowed from $1.43 to $1.01 per share in the past 60 days. Gamida Cell’s stock is up 70.9% this year so far.

Gamida Cell beat estimates in three of the last four quarters while missing in one, with the average positive surprise being 12.92%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Voyager Therapeutics, Inc. (VYGR) : Free Stock Analysis Report

Gamida Cell Ltd. (GMDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance