Perrigo Co PLC (PRGO) Q1 2024 Earnings: Adjusted EPS Exceeds Expectations Despite Sales Dip

Adjusted diluted EPS: $0.29, a decline of 35.6% year-over-year, exceeding the estimated $0.23.

Net Income: Reported at $4 million, falling short of the estimated $31.30 million.

Revenue: Reported at $1.1 billion, above the estimated $1093.13 million.

Gross Margin: GAAP gross margin declined by 190 basis points to 33.1%; adjusted gross margin decreased by 90 basis points to 36.5%.

Operational Efficiency: Project Energize underway, targeting annualized pre-tax savings of $140 million to $170 million by 2026.

Consumer Self-Care International: Net sales up 4.7% year-over-year, with organic growth of 7.0%.

Consumer Self-Care Americas: Net sales down 15.7% year-over-year, heavily impacted by declines in infant formula sales and SKU prioritization actions.

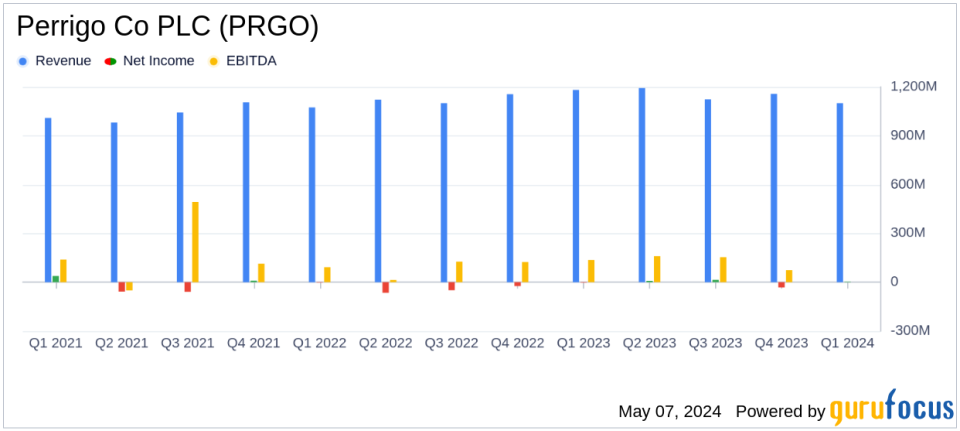

On May 7, 2024, Perrigo Co PLC (NYSE:PRGO) disclosed its first-quarter earnings for 2024 through its 8-K filing. The company reported an adjusted diluted earnings per share (EPS) of $0.29, surpassing the analyst estimate of $0.23. However, net sales declined by 8.4% to $1.1 billion, falling short of the anticipated $1.093 billion, driven primarily by challenges in the infant formula sector and SKU prioritization actions.

Company Overview

Perrigo, a leading global consumer self-care company, has streamlined its focus towards consumer health products since divesting its animal health and generic pharmaceuticals businesses in 2018. The company's portfolio, predominantly private-label products, is distributed through major retailers like Walmart, Amazon, and CVS in North America, which constitutes two-thirds of its sales. In international markets, Perrigo is known for brands such as Compeed and Solpadeine.

Financial Performance and Challenges

The first quarter saw a significant impact from the infant formula sector, where net sales dropped by 4.3 percentage points due to efforts to enhance the product network. This, combined with a 3.6 percentage point decrease from SKU prioritization intended to boost margins, overshadowed a 0.9 percentage point increase in organic net sales in other areas. The Consumer Self-Care International segment, however, displayed resilience with a 4.7% increase in net sales.

Despite the revenue challenges, Perrigo's adjusted gross margin was reported at 36.5%, a decrease of 90 basis points, primarily due to the 280 basis points impact from the infant formula segment. The company's GAAP gross margin also declined by 190 basis points to 33.1%.

Operational Highlights and Strategic Initiatives

The quarter featured significant operational activities including the advancement of the "Project Energize" initiative, aimed at enhancing global investment and efficiency. This program is expected to yield substantial long-term savings, projected between $140 million to $170 million by 2026, with a reinvestment of $40 million to $60 million into the business. The company also launched Opill, the first over-the-counter oral contraceptive in the U.S., now available in over 65,000 retail stores nationwide.

Financial Statements Insights

For the first quarter, Perrigo reported a net income of $4 million, or $0.03 per diluted share, an improvement from a net loss in the previous year. The adjusted net income stood at $40 million, or $0.29 per diluted share, reflecting a 35.6% decline from the prior year, largely due to the $0.30 impact from the infant formula segment.

The balance sheet remains robust with $659 million in cash and cash equivalents. Total debt was reported at $4.1 billion, consistent with the previous year. The company also returned $38 million to shareholders through dividends during the quarter.

Outlook and Forward Strategy

Perrigo reaffirmed its fiscal 2024 outlook, projecting organic net sales growth between 1.0% and 3.0%, and an adjusted diluted EPS range of $2.50 to $2.65. The company remains committed to navigating current challenges, particularly in the infant formula sector, and leveraging strategic initiatives to drive long-term growth.

As Perrigo continues to streamline operations and focus on high-margin areas, investors and stakeholders will be watching closely how these strategies unfold in the coming quarters, particularly in response to the dynamic retail environment and consumer health trends.

Explore the complete 8-K earnings release (here) from Perrigo Co PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance