Update: Pentamaster International (HKG:1665) Stock Gained 30% In The Last Year

It hasn't been the best quarter for Pentamaster International Limited (HKG:1665) shareholders, since the share price has fallen 29% in that time. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. After all, the share price is up a market-beating 30% in that time.

View our latest analysis for Pentamaster International

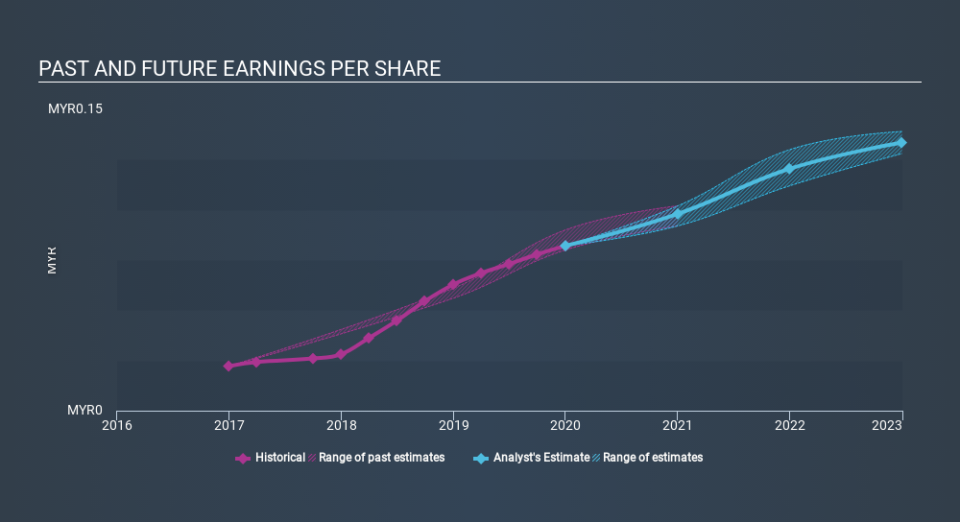

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Pentamaster International grew its earnings per share (EPS) by 31%. The similarity between the EPS growth and the 30% share price gain really stands out. This makes us think the market hasn't really changed its sentiment around the company, in the last year. It looks like the share price is responding to the EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Pentamaster International's TSR for the last year was 32%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Pentamaster International boasts a total shareholder return of 32% for the last year (that includes the dividends) . We regret to report that the share price is down 29% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand Pentamaster International better, we need to consider many other factors. Take risks, for example - Pentamaster International has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance