Pembina (PBA) Q4 Earnings Miss Estimates, Revenues Beat

Pembina Pipeline Corporation PBA reported fourth-quarter 2022 earnings per share (EPS) of 29 cents, missing the Zacks Consensus Estimate of 52 cents. This underperformance was primarily due to weak delivery in the company’s Marketing & New Ventures segment.

However, PBA’s bottom line was significantly above the year-ago quarter’s 6 cents on the back of strong Pipelines segment results.

The quarterly revenues of $2 million decreased 2.1% year over year, but beat the Zacks Consensus Estimate of $1.5 million.

Operating cash flow was C$947 million. Adjusted EBITDA was C$925 million, down C$45 million from the year-ago quarter’s tally.

In the fourth quarter of 2022, PBA saw volumes of 3,392 thousand barrels of oil equivalent per day (mboe/d), compared with 3,437 mboe/d in the year-ago quarter.

Pembina Pipeline announced first-quarter 2023 dividend of 65.25 Canadian cents per share, payable on Mar 31, 2023, to shareholders of record at the close of the business on Mar 15, 2023.

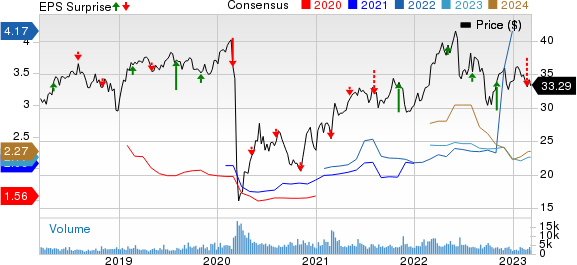

Pembina Pipeline Corp. Price, Consensus and EPS Surprise

Pembina Pipeline Corp. price-consensus-eps-surprise-chart | Pembina Pipeline Corp. Quote

Segmental Information

Pipelines: Adjusted EBITDA of C$548 million was in line with the year-ago quarter’s level, as the positive effects of the PGI deal and gas processing gains were offset by higher integrity costs. The year-over-year volume was marginally up about 0.8% to 2,593 mboe/d.

Facilities: Adjusted EBITDA of C$288 million improved marginally from the year-ago quarter’s C$285 million. The upside could be primarily attributed to the strong performance of PGI assets, partly offset by higher expenses. However, volumes of 799 mboe/d fell by about 7.8% year over year due to divestments.

Marketing & New Ventures: Adjusted EBITDA of C$171 million was lower than the year-ago quarter’s C$183 million. It was due to lower margins on NGL (natural gas liquids) sales and lower contributions from Aux Sable.

The Marketing & New Ventures segment recorded NGL volumes of 193 mboe/d in the fourth quarter of 2022.

Capital Expenditure & Balance Sheet

Pembina Pipeline spent C$143 million as capital expenditure during the fourth quarter of 2022 compared with C$176 million in the year-ago quarter.

As of Dec 31, 2022, PBA had cash and cash equivalents worth C$94 million and a long-term debt of C$9.4 billion.

Guidance

For full-year 2023, Pembina Pipeline expects its adjusted EBITDA in the range of C$3.5-$3.8 billion.

Pembina anticipates a 2023 capital program of C$800 million.

Pembina predicts good performance in its Marketing and New Ventures segment in 2023, but results may not be as strong as in 2022. This is due to the effect of significant volumes on the Northern and Northeast BC Pipeline system.

Pembina expects to maintain strong financial stability in 2023 with good liquidity and leverage metrics that meet the criteria for a strong BBB credit rating.

Zacks Rank and Key Picks

Currently, Pembina Pipeline carries a Zacks Rank #3 (Hold). Investors interested in the energy sector might look at some better-ranked stocks like NGL Energy Partners (NGL) sporting a Zacks Rank #1 (Strong Buy) and Energy Transfer ET and Halliburton (HAL) both holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NGL Energy Partners: NGL Energy Partners is worth approximately $509.53 million. Its shares have increased 48.8% in the past year.

NGL Energy Partners LP is a limited partnership company that operates a vertically-integrated propane business with three segments — retail propane, wholesale supply and marketing, and midstream.

Energy Transfer LP: Energy Transfer LP is valued at around $40.85 billion. ET delivered an average earnings surprise of 11.43% for the last four quarters, and its current dividend yield is 9.48%.

Energy Transfer LP currently has a forward P/E ratio of 9.17. In comparison, its industry has an average forward P/E of 9.40, which means Energy Transfer LP is trading at a discount to the group.

Halliburton: Halliburton is valued at around $35.16 billion. In the past year, HAL stock has increased by 3.4%.

TX-based Halliburton Company, headquartered in Houston, is one of the largest oilfield service providers in the world, with a trailing four-quarter earnings surprise of roughly 5.87%, on average.

Halliburton: Halliburton is valued at around $35.16 billion. In the past year, HAL stock has increased by 3.4%.

TX-based Halliburton Company, headquartered in Houston, is one of the largest oilfield service providers in the world, with a trailing four-quarter earnings surprise of roughly 5.87%, on average.

Halliburton: Halliburton is valued at around $35.16 billion. In the past year, HAL stock has increased by 3.4%.

TX-based Halliburton Company, headquartered in Houston, is one of the largest oilfield service providers in the world, with a trailing four-quarter earnings surprise of roughly 5.87%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

NGL Energy Partners LP (NGL) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance