PayPal Q4 Preview: Can Shares Remain Strong?

Earnings season is undoubtedly one of the most critical periods for stocks, with companies finally breaking the silence and revealing what’s transpired behind closed curtains.

Many companies have reported thus far, with just as many scheduled to do the same in the upcoming weeks.

This week, a well-known stock, PayPal PYPL, is on deck to unveil its Q4 earnings on Thursday, February 9th, after the market close.

PayPal has emerged as one of the largest online payment solutions providers thanks to its strong product portfolio and two-sided platform that allows smooth and secure transactions.

How does the company currently stack up? We can use results received already from Visa V as a small gauge. Let’s take a closer look.

Visa Q1

Visa reported better-than-expected results, posting EPS of $2.18 and handily beating the Zacks Consensus EPS Estimate by 8.5%.

Quarterly revenue totaled $7.9 billion, more than 3% above estimates and growing a solid 12% year-over-year. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

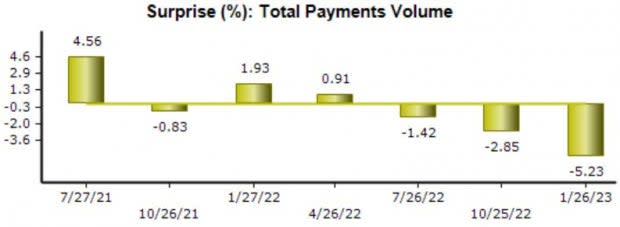

Of course, a focus point of the release was the company’s Total Payments Volume (TPV). For the quarter, Total Payments Volume totaled roughly $3 billion, falling short of our consensus estimate by 5% but growing 1.4% year-over-year.

It represented Visa’s third consecutive quarter falling short of our consensus estimate for Total Payments Volume, as seen in the chart below.

Image Source: Zacks Investment Research

PayPal

Total Payments Volume –

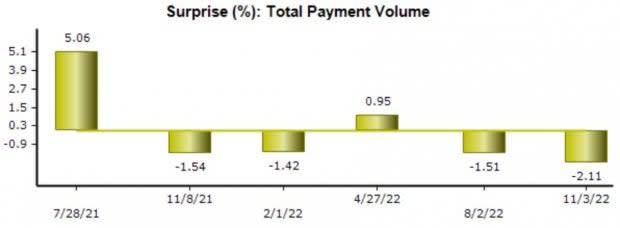

Like Visa, PayPal’s Total Payments Volume will be closely monitored. For the quarter, our consensus estimate for Total Payments Volume stands firm at $359.2 billion, suggesting an improvement of nearly 6% year-over-year.

PayPal has primarily fallen short of our consensus estimate for TPV, with four misses coming across its last six quarters.

Image Source: Zacks Investment Research

Quarterly Estimates –

Analysts have had a favorable view regarding the quarter to be reported, with six upward earnings estimate revisions hitting the tape over the last 60 days. The Zacks Consensus EPS Estimate of $1.20 suggests an 8% decline in earnings year-over-year.

Image Source: Zacks Investment Research

PYPL’s top line is in better standing, with our $7.4 billion consensus revenue estimate suggesting an uptick of nearly 7% year-over-year.

Quarterly Performance –

PayPal has posted solid quarterly results as of late, exceeding both earnings and revenue estimates in back-to-back quarters.

Just in its latest release, the company registered a 14% EPS beat and posted revenue modestly above expectations.

Image Source: Zacks Investment Research

Valuation –

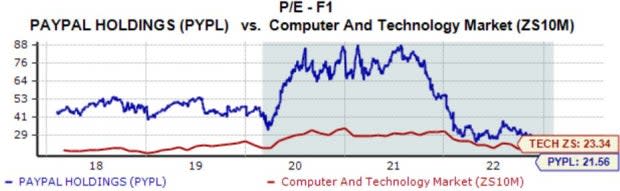

Currently, PYPL shares trade at a 21.6X forward earnings multiple, a fraction of the steep 47.6X five-year median.

Image Source: Zacks Investment Research

Further, the company’s forward price-to-sales works out to be 3.2X, again well below the 6.9X five-year median.

Image Source: Zacks Investment Research

PayPal carries a Style Score of “B” for Value.

Putting Everything Together

Earnings season continues to chug along, with a surplus of companies reporting daily.

This week, we’ll receive results from PayPal on Thursday, February 9th, after the market close. We already received results from a peer, Visa V, with the company posting a double-beat.

Analysts have been optimistic for PYPL’s quarter, with estimates reflecting a pullback in earnings but an uptick in revenue year-over-year.

In addition, the company’s Total Payments Volume will be monitored closely.

Further, PYPL’s valuation multiples have pulled back, with the company’s forward price-to-sales and forward earnings multiple nowhere near their respective five-year medians.

Heading into the print, PayPal PYPL is a Zacks Rank #3 (Hold) with an Earnings ESP Score of 0.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Visa Inc. (V) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance