PayPal Gains 12.9% YTD: Should You Still Purchase the Stock?

PayPal Holdings, Inc. PYPL continues to exhibit strong fundamentals, driven by its constant efforts to expand its portfolio of solutions.

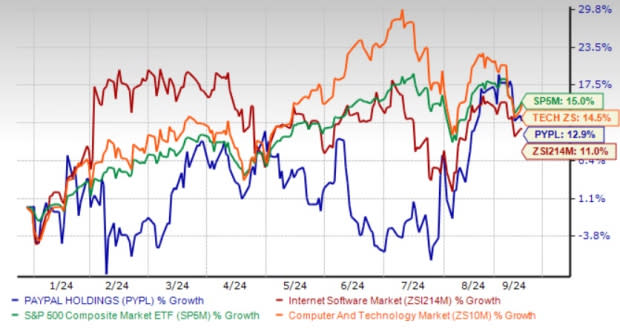

The company, which is one of the largest online payment solutions providers, has seen its shares rise 12.9% year to date, outpacing the Zacks Internet-Software industry’s 11% rise. Such an impressive gain naturally leads investors to wonder whether PayPal is still a compelling buy or if it is time to lock in profits.

The company has been benefiting from solid execution, payment platform enhancement and customer strategies. PayPal’s solid prospects in the cryptocurrency space are other positives.

Its comprehensive payment ecosystem, which connects merchants and customers seamlessly, is expected to continue bolstering its competitive position against its closest peer, Block SQ, as well as traditional fintech companies like MasterCard and Visa.

However, the PYPL stock has underperformed the broader technology sector and the S&P 500 index’s rallies of 14.5% and 15%, respectively. Market uncertainties, high inflation, unfavorable foreign exchange fluctuations and sluggish trends in consumer spending do not bode well for the company’s prospects.

Year-To-Date Price Performance

Image Source: Zacks Investment Research

Hence, investors should pay close attention to the company’s operational improvements across large enterprises, small businesses and consumers, as the payment giant's stock presents both opportunities and challenges that warrant careful consideration.

Expanding Portfolio Drives PayPal’s Prospects

PYPL’s portfolio strength has been helping it maintain a deep and trusted relationship with merchants and consumers. Its two-sided platform helps develop direct financial relationships with customers and merchants.

The company recently introduced a single solution for every type of customer everywhere they shop with its initiative of 'PayPal Everywhere.' It enables customers to have access to rich rewards and stackable cash-back offers within the PayPal app. The initiative will also make online payments for shopping hassle-free with features like simple sign-up, auto-reload, Tap-to-Pay and secured transactions.

PayPal’s unveiling of Fastlane, which enhances the guest checkout experience by allowing users to complete their purchase in one click, remains noteworthy. Currently, it is available in the United States. Fastlane is based on the company's decades of payment expertise to innovate and accelerate the guest checkout experience.

Solid momentum across PYPL’s branded checkout and Venmo are contributing significantly to transaction margin growth of the company. It is witnessing strong monthly active account growth due to the increasing adoption of PayPal and Venmo.

The growing momentum of the PayPal Complete Payments platform is another positive. The company is gaining strong momentum across small and medium-sized businesses with the PayPal Complete Payments platform. The expansion in the platform’s geographic reach to more than 34 countries is a major positive.

Strength in Braintree is a tailwind. The company is witnessing rising unbranded transactions processed through Braintree, which is noteworthy.

PYPL is also shifting to more password-less authentication processes like biometrics. It plans to launch a redesigned mobile checkout experience. This is expected to result in higher conversion rates.

On the customer front, the solid adoption of the PayPal debit card is continuously boosting transaction activities on the company’s platform and driving growth in the average revenue per account.

In the cryptocurrency domain, PayPal is one of the well-known crypto stocks that should be focused on.

The company provides a feature called Crypto on Venmo, which allows Venmo customers to buy, hold and sell cryptocurrency directly within the Venmo app. It also offers a feature called Checkout with Crypto, which lets customers convert their cryptocurrency holdings seamlessly into fiat currency at the time of checkout.

Strong Partner Base to Aid PYPL Stock

PayPal continues to forge strategic partnerships as part of its growth initiatives.

Recently, the company teamed up with Fiserv FI to streamline checkout experiences in the United States. This partnership allows Fiserv clients to enable PayPal, Venmo and related services seamlessly, and provides these businesses with a simple connection point to Fastlane by PayPal to accelerate guest checkout flows.

PYPL partnered with Adyen. Per the terms, Adyen will offer Fastlane by PayPal to accelerate guest checkout flows for its enterprise and marketplace customers in the United States.

The company also expanded its global strategic partnership with Shopify SHOP, as part of which its wallet transactions will be integrated into Shopify Payments in the United States. With this, PYPL has become the online credit and debit card processor for Shopify Payments through PayPal Complete Payments.

PayPal’s collaboration with Apple and Alphabet to integrate the Venmo debit card with Apple Pay and Google Pay is a plus.

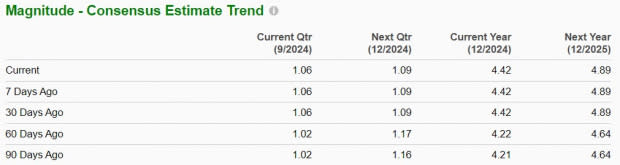

Upward Estimate Revision Bodes Well for PYPL

PayPal’s portfolio strength and strong partner base are expected to drive its prospects in the long run and the near term.

For third-quarter 2024, PYPL expects year-over-year mid-single-digit growth in revenues. The Zacks Consensus Estimate for the same is pegged at $7.85 billion, indicating year-over-year growth of 5.8%.

The company expects non-GAAP earnings per share to exhibit high-single-digit growth on a year-over-year basis. The consensus mark for the same is pegged at $1.06, which has been revised upward by 3.9% over the past 60 days.

For 2024, PayPal anticipates non-GAAP earnings per share to grow in the low to mid-teens from that reported in 2023. The Zacks Consensus Estimate for the same stands at $4.42, which has moved north by 4.7% in the past 60 days.

The consensus mark for 2024 revenues is pegged at $31.95 billion, indicating year-over-year growth of 7.3%.

Image Source: Zacks Investment Research

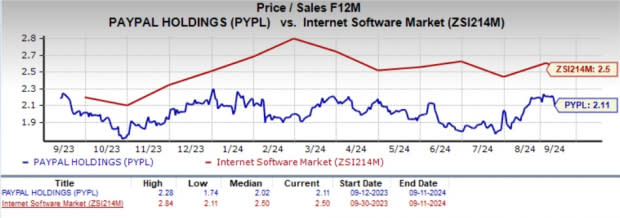

Attractive Valuation: A Silver Lining

PayPal is trading at a discount with a forward 12-month Price/Sales of 2.11X compared with the industry’s 2.5X. This indicates robust opportunities for investors.

The company’s Value Score of A is hard to ignore.

Image Source: Zacks Investment Research

Conclusion

PayPal’s commitment to democratize financial services in order to improve the financial health of customers, and boost economic opportunities for entrepreneurs and businesses of all sizes around the world is a major positive.

PYPL appears to be a solid investment proposition at present, with solid fundamentals, healthy revenue-generating potential on portfolio strength and expanding partnerships, rising earnings estimates, and attractive valuation.

Currently, PayPal sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fiserv, Inc. (FI) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance