Paya Holdings (NASDAQ:PAYA) shareholders have endured a 13% loss from investing in the stock a year ago

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Paya Holdings Inc. (NASDAQ:PAYA) have tasted that bitter downside in the last year, as the share price dropped 13%. That's disappointing when you consider the market returned 33%. Because Paya Holdings hasn't been listed for many years, the market is still learning about how the business performs. It's down 17% in about a quarter.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Paya Holdings

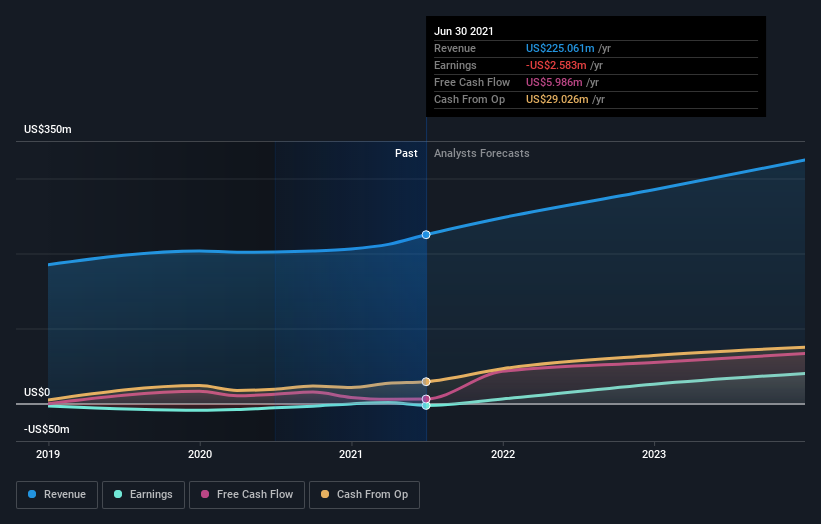

Given that Paya Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Paya Holdings increased its revenue by 11%. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 13% in a year. It's important not to lose sight of the fact that profitless companies must grow. So remember, if you buy a profitless company then you risk being a profitless investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Paya Holdings in this interactive graph of future profit estimates.

A Different Perspective

While Paya Holdings shareholders are down 13% for the year, the market itself is up 33%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 17% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand Paya Holdings better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Paya Holdings .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance