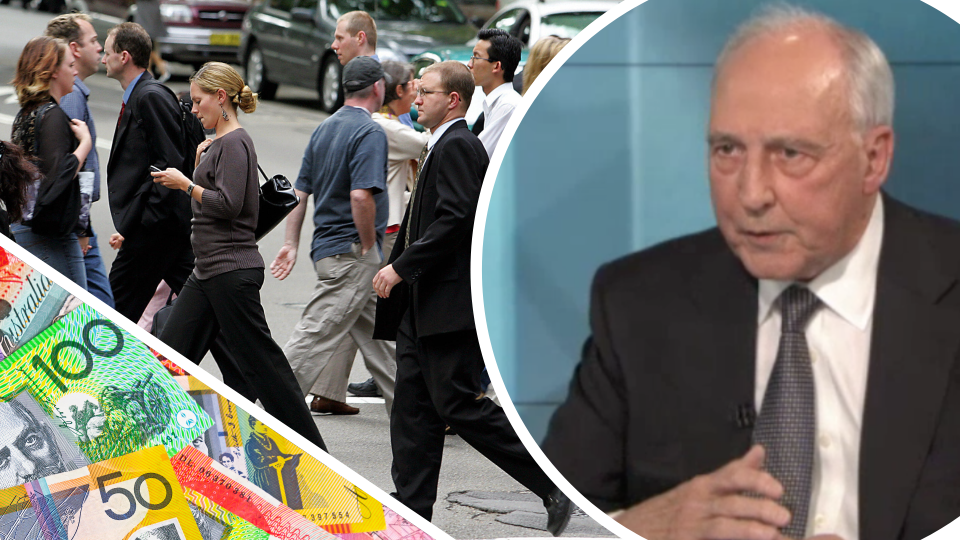

‘Like anti-vaxxers’: Paul Keating slams super critics

Former Prime Minister Paul Keating has slammed Coalition MPs’ attempts to prevent increases to the super rate, likening them to anti-vaxxers.

Keating said claims that increasing the rate of employees’ superannuation contributions from 9.5 per cent to 12 per cent would hold back wage growth were a “great lie” and that MPs calling for more flexibility in super for low-income workers were like “climate deniers”.

Related story: 'Laughable': Labor slams Liberal Senator's plan to make super voluntary

Related story: Will super changes really see Aussies lose $30k?

Speaking on the ABC’s 7:30 program, Keating said the wage argument was “demonstrably false” as Australians haven’t enjoyed any major wage growth since 2014, despite there being no increase in super.

Keating was one of superannuation’s founding fathers, making employer superannuation contributions compulsory in 1992.

His words come weeks after the Grattan Institute released a controversial report claiming that increases to the amount of superannuation paid could leave workers up to $30,000 worse off at retirement.

The institute argued that businesses would choose to stall wage growth in the face of higher superannuation payments, and any increase to low- and middle-income workers’ super would be largely offset by smaller pension payments.

Actuarial firm Rice Warner and the Association of Superannuation Funds of Australia (ASFA) both disputed the research.

However, a group of Liberal MPs have in recent weeks been arguing that the scheduled increase to superannuation should be deferred, cancelled or altered.

MP Tim Wilson said Australians should have a choice to either keep that scheduled increase as wages or put it into their super, while Senator Jane Hume - the new assistant minister for superannuation - said she has concerns the current system is inefficient.

"In my mind, no government in good conscience can demand workers compulsorily quarantine more of their money. I don't think the government can morally ask workers to give up more of their current earnings and put them into an inefficient system,” she told the Sydney Morning Herald.

Another MP, Andrew Bragg has suggested superannuation be made optional for Australia’s low-income earners to grant them more flexibility.

Related story: Finance minister shoots down super debate

Super critics like climate deniers

But Keating disagrees.

“It's like climate deniers. We've got a bunch of people in the Liberal Party who have always hated superannuation ... they are super deniers," Keating said.

"Someone said yesterday, pithily, they are like anti-vaxxers, they are against vaccine, you know?”

"The Parliament is currently legislated to 2.5 per cent extra super from 2021 to 2025. That's 2.5 per cent of income, whether you take it as savings or super or cash, it's still 2.5 per cent of income.”

"If this is refused, essentially what a Liberal Government would be doing is pilfering, stealing, robbing the workforce of 2.5 per cent of income."

Keating has, in recent weeks, come out strongly against proposed changes to the superannuation system, telling the Australian Financial Review that if the super payment rate didn’t increase from 9.5 per cent, it would be a “grand theft”.

"It would be a retiree's tax on a grand scale. Right? Not the hundreds of thousands with excess imputation credits, who the Liberals call the retiree's tax, but a 2.5 per cent tax on 13 million Australian working persons. A real retiree's tax," he said.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance