Paladin Energy (ASX:PDN) shareholders are still up 854% over 5 years despite pulling back 14% in the past week

It certainly might concern Paladin Energy Limited (ASX:PDN) shareholders to see the share price down 30% in just 30 days. But that doesn't change the fact that the returns over the last half decade have been spectacular. In that time, the share price has soared some 834% higher! So we don't think the recent decline in the share price means its story is a sad one. But the real question is whether the business fundamentals can improve over the long term. We love happy stories like this one. The company should be really proud of that performance!

Since the long term performance has been good but there's been a recent pullback of 14%, let's check if the fundamentals match the share price.

Check out our latest analysis for Paladin Energy

Paladin Energy recorded just US$2,985,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Paladin Energy will discover or develop fossil fuel before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Paladin Energy has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

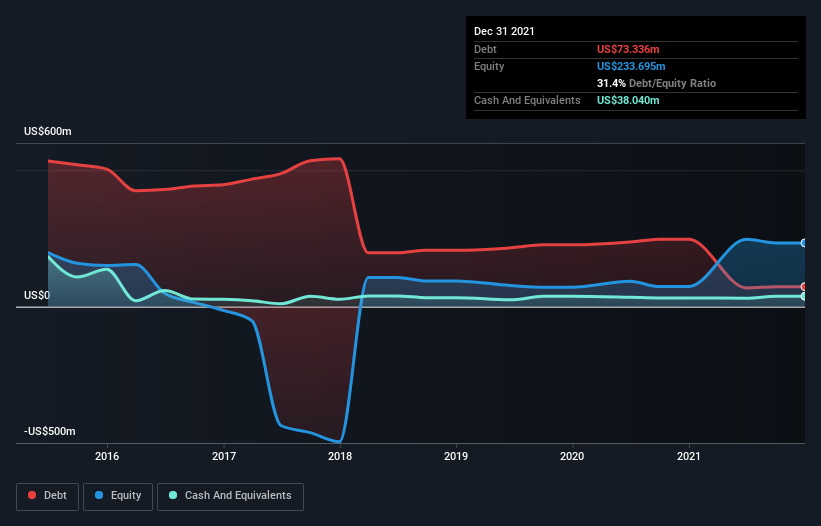

Paladin Energy had liabilities exceeding cash by US$77m when it last reported in December 2021, according to our data. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 31% per year, over 5 years shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. You can click on the image below to see (in greater detail) how Paladin Energy's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

What about the Total Shareholder Return (TSR)?

We've already covered Paladin Energy's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Paladin Energy hasn't been paying dividends, but its TSR of 854% exceeds its share price return of 834%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Paladin Energy shareholders have received a total shareholder return of 34% over the last year. However, that falls short of the 57% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Paladin Energy has 4 warning signs we think you should be aware of.

But note: Paladin Energy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance