Pacira BioSciences (NASDAQ:PCRX) stock falls 4.1% in past week as three-year earnings and shareholder returns continue downward trend

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Pacira BioSciences, Inc. (NASDAQ:PCRX) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 60% drop in the share price over that period. The more recent news is of little comfort, with the share price down 33% in a year. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

With the stock having lost 4.1% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Pacira BioSciences

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

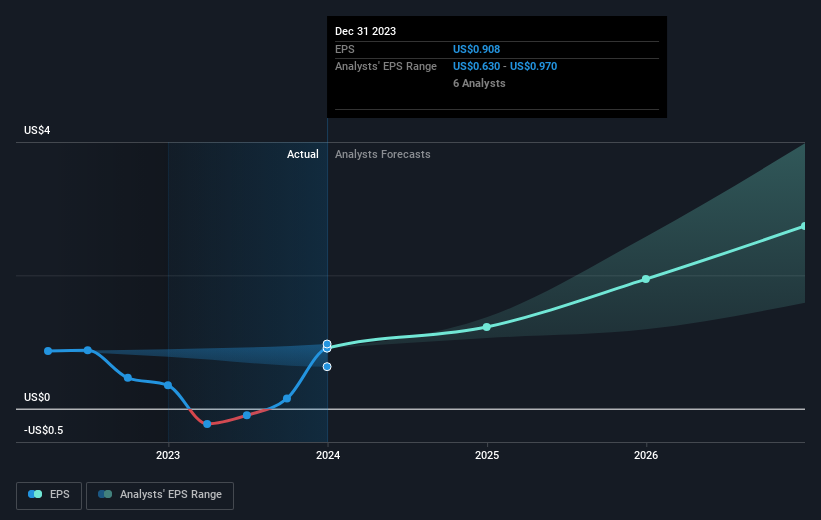

During the three years that the share price fell, Pacira BioSciences' earnings per share (EPS) dropped by 36% each year. In comparison the 26% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Pacira BioSciences has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

While the broader market gained around 27% in the last year, Pacira BioSciences shareholders lost 33%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Pacira BioSciences has 2 warning signs we think you should be aware of.

Of course Pacira BioSciences may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance