Oshkosh (OSK) Q4 Earnings & Revenues Beat Estimates, Up Y/Y

Oshkosh Corporation OSK recorded earnings of $2.17 per share in the fourth quarter of fiscal 2019 (Sep 30, 2019), beating the Zacks Consensus Estimate of $1.88, mainly impactedby higher sales, improved pricing and application of the new revenue recognition standard. In the year-ago quarter, earnings were $2.05 per share. Net income was $150 million compared with the year-ago quarter’s $151.3 million.

In the reported quarter, consolidated net sales rose 6.7% to $2.20 billion. The figure also surpassed the Zacks Consensus Estimate of $2.11 billion. This upside resulted from higher sales in the company’s Defense, Fire & Emergency and Commercial segments.

In fiscal fourth quarter, consolidated operating income inched up 0.6% year over to $203.1 million (9.2% of sales).

Segmental Details

Net sales in the Access equipment decreased 4.2% year over year to $1.02 billion, due to lower sales volume in the Europe, Middle East and Africa region. In the quarter under review, operating income edged down 0.3% to $126.5 million (12.4% ofsales), primarily due tolower sales volume and higher marketing spending.

The Defense segment’s net sales increased 22.7% to $570.2 million in the quarter, owing to higher sales resulting from the continued ramp up of JLTV sales to the U.S. government. Operating income fell 19.8% to $50.5 million (8.9% of sales) due to the recognition of a pre-tax gain on a litigation settlement.

Net sales in the Fire & Emergency segment climbed 22.1% to $346.4 million in the reported quarter. Thisupside aided by sales of higher content units, application of new revenue recognition standard and improved pricing. The impact of higher sales volume and improved price/cost dynamics boosted operating income by 23.9% to $49.3 million (14.2% of sales).

Net sales in the Commercial segment went up 4.6% to $266 million in the quarter, backed by higher refuse collection vehicle sales volumes. The segment’s operating income increased to $18.8 million (7.1% of sales) from the $17.7 million (7% of sales) reported in the year-ago quarter, mainly aided by higher sales.

Financial Details

Oshkosh had cash and cash equivalents of $448.4 million as of Sep 30, 2019 compared with $454.6 million as of Sep 30, 2018. The company’s long-term debt was $819 million in the fiscal fourth quarter compared with $818 millionas of Sep 30, 2018.The debt-to-capital ratio stands at 23.95%.

Oshkosh’s net cash provided by operating activities was $589.1 million as of Sep 30, 2019 compared with $436.3 million reported at the end of the year-ago period.

Share Buyback & Dividend

During the September-end quarter, the company repurchased 822,905 shares of common stock for $66.2 million.

Oshkosh’s board has announced a quarterly cash dividend of 30 cents per share for its shareholders. The amount will be paid on Dec 2, to shareholders as of Nov 18, 2019.

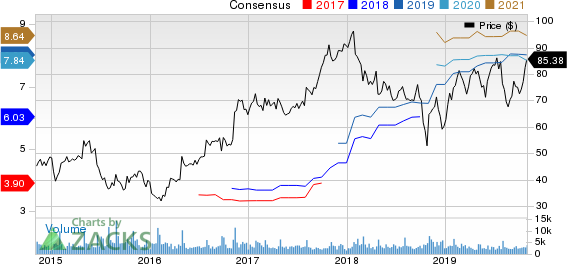

Oshkosh Corporation Price and Consensus

Oshkosh Corporation price-consensus-chart | Oshkosh Corporation Quote

Fiscal 2020 Outlook

For fiscal 2020, the company anticipates diluted earnings per share estimate in the range of $7.30-$8.10. Further, net sales are projected between $7.9 billion and $8.2 billion, and operating income is expected in the band of $690-$765 million.

Zacks Rank & Stocks to Consider

Currently, Oshkosh carriesa Zacks Rank #3 (Hold).

A few better-ranked stocks worth considering are Kinross Gold Corporation KGC, sporting a Zacks Rank #1 (Strong Buy), Iochpe-Maxion SA IOCJY and BRP Inc. DOOO, both carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross Gold has an expected earnings growth rate ofa whopping 210% for 2019. The company’s shares have surged75.7% in the past year.

Iochpe-Maxion has an estimated earnings growth rate of 50% for the ongoing year. The company’s shares have ralliedroughly 4.6% in a year’s time.

BRP has a projected earnings growth rate of 18.49% for the current year. Its shares have gained around 11.1% over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

Iochpe-Maxion SA (IOCJY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance