The New Oriental Education & Technology Group (NYSE:EDU) Share Price Is Up 421% And Shareholders Are Delighted

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. To wit, the New Oriental Education & Technology Group Inc. (NYSE:EDU) share price has soared 421% over five years. If that doesn't get you thinking about long term investing, we don't know what will. On top of that, the share price is up 22% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for New Oriental Education & Technology Group

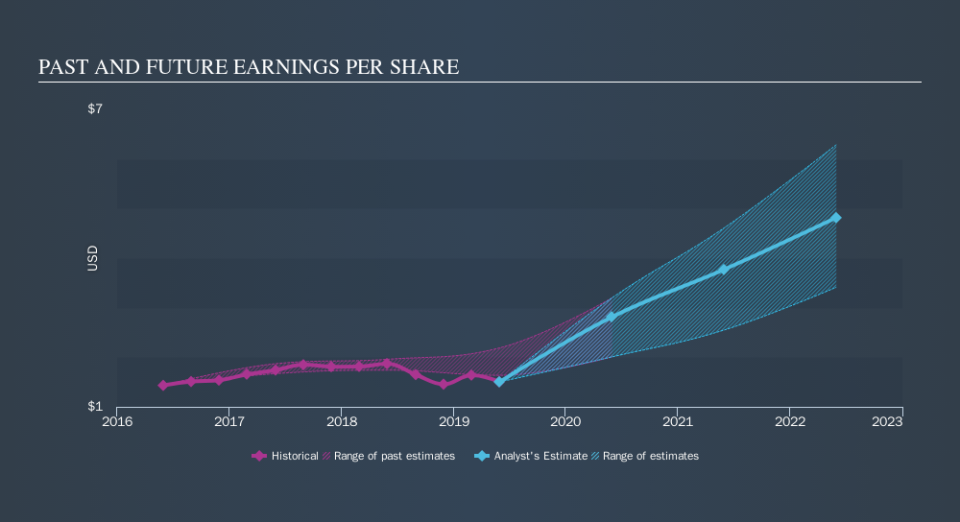

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, New Oriental Education & Technology Group managed to grow its earnings per share at 1.7% a year. This EPS growth is slower than the share price growth of 39% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 75.85.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into New Oriental Education & Technology Group's key metrics by checking this interactive graph of New Oriental Education & Technology Group's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between New Oriental Education & Technology Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that New Oriental Education & Technology Group's TSR of 434% over the last 5 years is better than the share price return.

A Different Perspective

We're pleased to report that New Oriental Education & Technology Group shareholders have received a total shareholder return of 88% over one year. That gain is better than the annual TSR over five years, which is 40%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before forming an opinion on New Oriental Education & Technology Group you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance