Opportunities for Euro Traders with Patience

The Euro gained on the U.S Dollar yesterday after the rather unimpressive Consumer Price Index numbers from the States.

Unimpressive Inflation Data from U.S Helps Euro

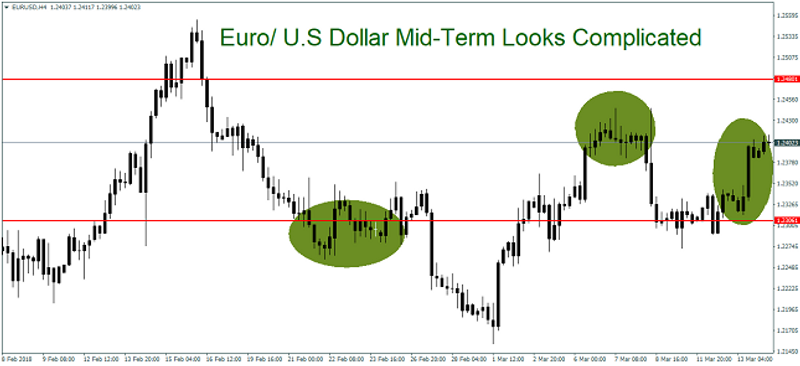

The Euro has proved mid-term that traders looking for quick speculative gains often run into trouble because of sudden market gyrations. However, traders who have the ability to be patient and not overextend their leverage create the likelihood of better results.

This because they are often able to handle volatility better. And the Euro may continue to offer opportunities for traders who can look at forex with a longer perspective than just one day. The Euro is near 1.24 versus the U.S Dollar after rather unimpressive inflation data from the States yesterday.

Suggested Articles

Encouraging Long-Term Chart for Euro

Resistance for the Euro looks to be around 1.2480 near term, while support appears to be around 1.23. And Europe will issue its Consumer Price Index data on Friday.

A look at a long-term chart of the Euro versus U.S Dollar actually shows a consolidated range is forming, and Euro bulls may be encouraged with this view.

In the short term, we believe the Euro may be positive. The mid-term and Long term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance