The Only High-Yield Stocks I'd Consider Buying in 2019

When I first learned about dividends, I became enamored with them. I had no idea that some companies actually paid you cash to own them. I figured I couldn't lose if I focused on buying stocks that sported dividend yields of 10%, 12%, or more.

Experience soon taught me that a high yield is actually a warning sign that the underlying business is in trouble. Many of the "no-brainer" stocks that I bought stopped paying their dividends, and their share prices got walloped. It was a double-whammy that I will never forget.

While I no longer invest for income, I do think that there are a few high-yield stocks on the market that could be worth owning. Here's why I could see myself buying Brookfield Infrastructure Partners (NYSE: BIP), STORE Capital (NYSE: STOR), and Crown Castle International (NYSE: CCI) one day.

Image source: Getty Images.

Brookfield Infrastructure Partners

With a dividend yield of 5.6%, Brookfield Infrastructure Partners easily qualifies as a high-yield stock.

Brookfield is structured as a limited partnership, and it focuses on buying one-of-a-kind infrastructure assets that produce predictable cash flow. These assets include things like shipping ports, railroads, toll roads, pipelines, data centers, communications towers, and more. The company aims to buy these assets at a value, and then pass along the income back to its investors in the form of a growing distribution.

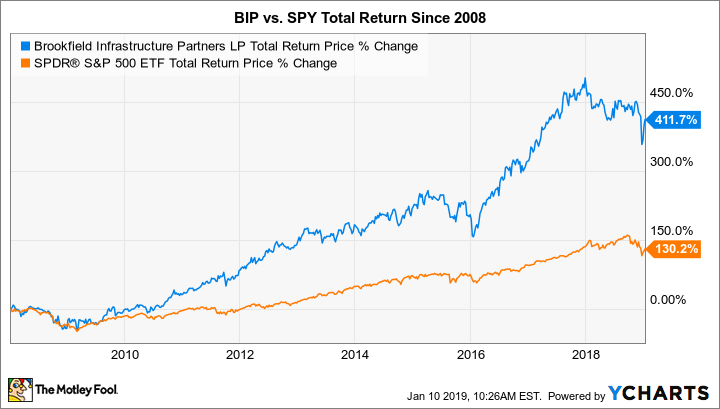

A look at the company's long-term track record proves that its business model works well:

BIP Total Return Price data by YCharts

While Brookfield has been a monster winner over the long-term, 2018 was a challenging year for the business. Some of its assets experienced headwinds, and the company also sold a sizable electric transmission business in Chile in 2017 for a cool $1.3 billion. These factors pulled down its growth rates while management worked to redeploy that capital.

The company has since closed on a number of acquisitions that will replace that lost revenue and profits. However, those numbers haven't shown up in the company's financials yet. That's expected to change in 2019, as management is calling for funds from operations (FFO) growth of about 20% once all of its projects are completed. That should easily allow it to meet its target of hiking its payout to investors by at least 5% annually.

Overall, Brookfield is a terrific company that pays a huge yield and is currently trading on sale. That's a combination that any income-seeking investor should like.

STORE Capital

The "STORE" in STORE Capital stands for Single Tenant Operational Real Estate. True to its name, STORE focuses its capital on buying freestanding retail buildings that are leased out to a single occupant. This business model may make you roll your eyes in today's e-commerce-driven world, but STORE takes a number of precautions to insulate itself from the threat.

First, STORE primarily focuses on service businesses that are naturally resistant to online competition (fitness centers, auto repair shops, movie theaters, etc.). Second, the company makes all of its tenants sign long-term, triple-net leases. This offloads all of a building's operational expenses to the tenant, and keeps them in the building for a long time (the current average contract length is 14 years). Finally, STORE requires its customers to provide regular financial updates and continually prove that they are financially viable. This allows STORE to take action before its customers go belly up.

When these factors are added together, it is no wonder that the company has maintained an occupancy rate above 99% for years. That's why I have high confidence that the company's massive dividend yield of 4.3% will continue to be paid, and can continue to grow from here.

It is also worth mentioning that I'm not alone in my affinity for STORE Capital; a certain folksy billionaire from Omaha actually took a 10% position in the business.

Crown Castle International

The explosion in smartphone popularity over the last decade has caused the demand for cell towers to skyrocket. However, finding great cell tower locations isn't easy, as there is only so much real estate available and most people don't want a cell tower in their backyard.

One way that the big carriers have solved this dilemma is by partnering with real estate companies that specialize in owning and operating cell towers. Crown Castle is one of the biggest players in the industry, and is a natural partner for the biggest carriers: It owns a huge network of 40,000 cell towers, 65,000 small cell towers, and 65,000 miles of fiber optic cable that are spread across the U.S. By plugging into this network carriers can gain easy access to great locations without any of the hassles.

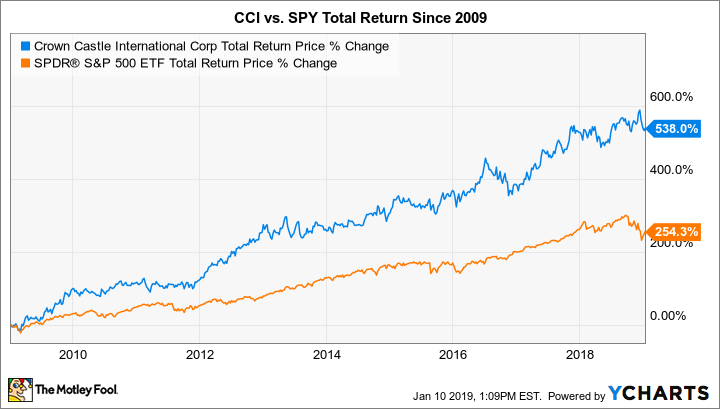

A wonderful feature of Crown Castle's business model is that it builds price increases into the contracts that its customers sign. When combined with new tower construction and occasional acquisition, Crown Castle has driven consistent revenue and profit growth for years, and has generated exceptional returns for investors.

CCI Total Return Price data by YCharts

I think that two massive tech trends should help the company drive continued growth in the years ahead. The first is the internet of things, which promises to bring billions of new devices online over the next couple of years. The second is the upcoming rollout of 5G networks, which should help keep cell towers in demand.

All told, I think that Crown Castle can continue to post double-digit profit growth for years to come. Adding a monster dividend yield of 4.2% to the picture only acts as icing on the cake.

More From The Motley Fool

Brian Feroldi has no position in any of the stocks mentioned. The Motley Fool recommends Brookfield Infrastructure Partners and Crown Castle International. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance