Omnicell (OMCL) Beats on Earnings in Q2, Tapers '19 EPS View

Omnicell, Inc.’s OMCL second-quarter 2019 adjusted earnings per share (EPS) of 67 cents outpaced the Zacks Consensus Estimate by 4.7%.

Also, adjusted EPS surged 45.6% from the year-ago figure and surpassed the company’s guided range of 61-66 cents as well.

Revenues in Detail

Adjusted revenues in the second quarter increased 15.2% year over year to $217.4 million. The top line also trumped the Zacks Consensus Estimate of $213 million.

Quarterly Details

On a segmental basis, Product revenues improved 17.7% year over year to $158.4 million in the reported quarter.

Moreover, Service and other revenues climbed 9.2% year over year to $59 million.

Operational Update

In the quarter under review, Omnicell's adjusted gross profit rose 17.2% to $104 million. Adjusted gross margin expanded 80 basis points (bps) to 47.9%.

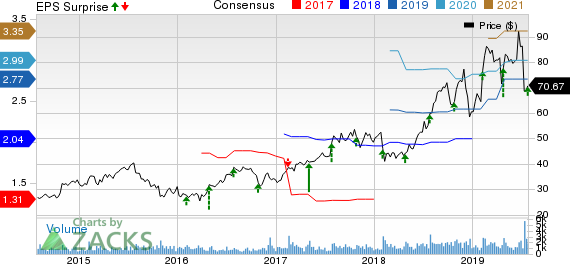

Omnicell, Inc. Price, Consensus and EPS Surprise

Omnicell, Inc. price-consensus-eps-surprise-chart | Omnicell, Inc. Quote

Adjusted operating profit totaled $18.8 million, reflecting a 155.8% jump from the prior-year quarter. Adjusted operating margin in the second quarter grew 474 bps to 13%.

SG&A expenses inched up 3.8% year over year to $68.4 million. Moreover, research and development expenses escalated 8.6% year over year to $16.8 million. Also, adjusted operating expenses were $85.2 million in the second quarter, up 4.7% year over year.

Financial Update

Omnicell exited the second quarter with cash and cash equivalents of $87.5 million compared with $77.2 million at the end of the first quarter.

Guidance

For the third quarter of 2019, Omnicell expects adjusted revenues between $227 million and $233 million. The Zacks Consensus Estimate for the metric stands at $231.9 million, within the guided range.

On an adjusted basis, product revenues are expected between $168 million and $173 million while service revenues are projected within $59-$60 million.

Third-quarter adjusted EPS is envisioned in the band of 67-72 cents. The Zacks Consensus Estimate for the same is pegged at 71 cents, close to the upper end of the predicted range.

For 2019, adjusted revenues are now anticipated within $886-$900 million, narrowed from the earlier band of $880-$900 million. The Zacks Consensus Estimate for the same is pinned on $891.9 million, within the guided range.

Product revenues for the full year are estimated within $653-$663 million while service revenues are expected between $233 million and $237 million.

Adjusted EPS is forecast between $2.65 and $2.82 for 2019 (earlier range was $2.62-$2.82). The Zacks Consensus Estimate for the metric stands at $2.77, within the guided range.

Our Take

Omnicell delivered impressive second-quarter 2019 results. The company continued to see solid segmental contributions. Its solid year-over-year EPS growth is a major positive. Moreover, Omnicell inked various deals for both the XR2 and the IVX Workflow products. It issued an upbeat guidance for the third quarter as well as 2019.

Currently, the company is working on product innovation through R&D. Moving ahead, Omnicell is expected to gain traction from product launches, strategic partnerships and digital transformation. Expansion of gross and operating margins in the reported quarter is encouraging as well.

However, a tough competitive landscape acts as a dampener.

Zacks Rank

Omnicell currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader medical space are Hologic Inc. HOLX, DENTSPLY SIRONA Inc. XRAY and Teleflex Inc. TFX.

Hologic is scheduled to release second-quarter 2019 results on Jul 31. The Zacks Consensus Estimate for the quarter’s adjusted EPS is pegged at 61 cents and for revenues, stands at $834.6 million. The stock carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DENTSPLY SIRONA is scheduled to release second-quarter 2019 results on Aug 2. The Zacks Consensus Estimate for its adjusted EPS is pinned on 62 cents and for revenues, stands at $1.03 billion. The stock sports a Zacks Rank #1.

Teleflex is expected to release second-quarter 2019 results on Aug 1. The Zacks Consensus Estimate for its adjusted EPS is $2.59 and its top line, $636.7 million. The stock has a Zacks Rank of 2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance