Omega Healthcare (OHI) to Post Q2 Earnings: What's in Store?

Omega Healthcare Investors, Inc. OHI is slated to report second-quarter 2019 results on Aug 6, after the market closes. The company’s performance will likely reflect a year-over-year decline in funds from operations (FFO) per share, while its top line is anticipated to display growth.

In the last reported quarter, this real estate investment trust, which invests in the long-term healthcare industry, delivered a positive surprise of 4.11%, in terms of adjusted FFO per share. Results reflected year-over-year increase in operating revenues for the January-March quarter.

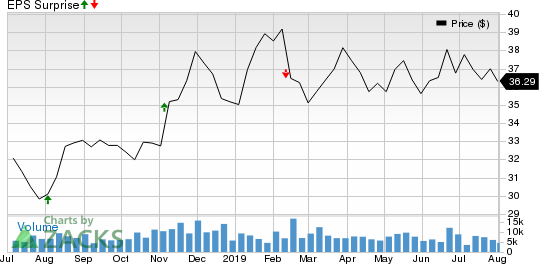

The company beat the Zacks consensus Estimate in three of the trailing four quarters, with an average positive surprise of 0.70%. This is depicted in the graph below.

Omega Healthcare Investors, Inc. Price and EPS Surprise

Omega Healthcare Investors, Inc. price-eps-surprise | Omega Healthcare Investors, Inc. Quote

Let’s see how things are shaping up, prior to this announcement.

Factors to Consider

Omega Healthcare, which invests in the long-term healthcare industry, mainly in skilled nursing (SNF) and assisted living facilities, has emerged as a leading SNF-focused REIT, and achieved diversification in terms of geography and operator in the United States and the U.K. The company’s properties are operated by a diverse group of healthcare companies, primarily in a triple-net lease structure. This diversification will likely have aided the company’s top line in the to-be-reported quarter. Portfolio occupancy is anticipated to benefit from positive demographic trends.

Further, Omega is aiming for accretive buyouts this year, after completing its strategic asset repositioning and portfolio restructurings in 2018. Such strategic disposition program offers solid scope for capital redeployment in its growth endeavors.

Notably, during the second quarter, Omega announced the completion of the cash-and-stock deal to acquire MedEquities Realty Trust, Inc. Valued at around $600 million, the transaction has helped in the diversification of Omega Healthcare’s assets as well as operators. Particularly, with this move, Omega Healthcare added a diversified portfolio of investments, including 34 properties in seven states, operated by 11 different operators.

However, revenue reduction related to its prior-year asset sales and tenant credit headwinds are likely to keep any robust growth in check. Additionally, the company projects its G&A expenses for second-quarter 2019 to be consistent with its first-quarter 2019 tally when normalizing for restructuring charges. In fact, the company expects to return to the usual level of $9-$10 million per quarter in second-half 2019 as legal expenses decline.

Amid these, the Zacks Consensus Estimate for second-quarter revenues of nearly $228.3 million underscores a rise of 3.8%, year over year. However, the Zacks Consensus Estimate for second-quarter 2019 FFO per share of 75 cents remained unchanged in a month’s time. It also indicates a 1.3% year-over-year decline.

Here is what our quantitative model predicts:

Omega Healthcare does not have the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Omega Healthcare’s Earnings ESP is 0.00%.

Zacks Rank: Omega Healthcare currently carries a Zacks Rank of 2 (Buy), which increases the predictive power of ESP. However, we also need a positive ESP to be confident of a positive surprise.

Stocks That Warrant a Look

Here are a few stocks in the broader real estate sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

MGM Growth Properties LLC MGP, scheduled to release earnings on Aug 6, has an Earnings ESP of +0.57% and currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Physicians Realty Trust DOC, set to report quarterly figures on Aug 7, has an Earnings ESP of +3.41% and carries a Zacks Rank of 2, currently.

Jones Lang LaSalle Incorporated JLL, slated to announce second-quarter results on Aug 6, has an Earnings ESP of +3.72% and holds a Zacks Rank of 2, at present.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

Physicians Realty Trust (DOC) : Free Stock Analysis Report

Omega Healthcare Investors, Inc. (OHI) : Free Stock Analysis Report

MGM Growth Properties LLC (MGP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance