Olin (OLN) to Redeem 10% Senior Notes Worth $185 Million

Olin Corporation OLN announced that it has informed its bondholders regarding its intent to redeem all $185 million of its outstanding 10% senior notes due Oct 15, 2025. The notes are likely to be redeemed on May 14, 2021 in cash at redemption price of 105% of the principal amount of the notes.

The senior notes were issued with respect to the 2015 Dow Chlorine Products acquisition. Olin expects to redeem the notes using $195 million of cash generated from operations.

The redemption of bonds reflects on the company’s strategy to utilize excess cash flow to lower debt levels. It is expected that the redemption will reduce annual interest expenses by roughly $19 million, the company noted.

Shares of Olin have surged 199.9% in the past year compared with 79.3% rise of the industry.

Olin, last month, stated that it now projects first-quarter adjusted EBITDA in the range of $475-$500 million, higher than $400-$425 million expected earlier.

The revised projection includes a net one-time benefit associated with Olin's customary financial hedges and contracts, maintained to provide protection from rapid and dramatic changes in energy costs. This is partly offset by unabsorbed fixed manufacturing expenses, reduced profit from lost sales and storm-related maintenance costs. The outlook for the first quarter has further upside potential related to the final settlement of these one-time items linked with the winter storm Uri.

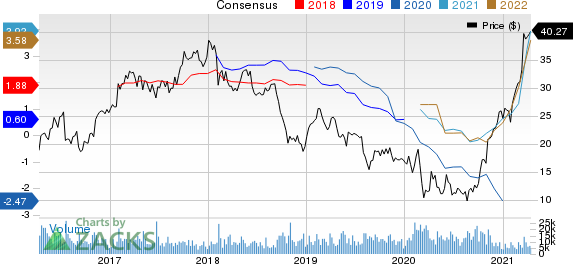

Olin Corporation Price and Consensus

Olin Corporation price-consensus-chart | Olin Corporation Quote

Zacks Rank & Other Key Picks

Olin currently carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, Nucor Corporation NUE and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of roughly105% for the current fiscal. The company’s shares have surged 128.5% in a year. It currently flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nucor has an expected earnings growth rate of around 171% for the current fiscal. The company’s shares have gained 122.6% in the past year. It currently sports a Zacks Rank #1.

Impala has an expected earnings growth rate of 197.6% for the current fiscal. The company’s shares have rallied 234.4% in the past year. It currently flaunts a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance