Old Dominion (ODFL) Posts LTL Unit Performance for May

Old Dominion Freight Line, Inc. ODFL provided an update on the performance of its less-than-truckload (LTL) segment, which is its primary revenue generator, in May.

Old Dominion's revenue per day improved 5.6% year over year in May 2024 due to an increase in LTL revenue per hundredweight, which was partially offset by a 1.5% rise in LTL tons per day. The uplift in LTL tons per day was due to a 0.7% decrease in LTL weight per shipment, which was partially offset by a 2.3% increase in LTL shipments per day.

Quarter to date, Old Dominion’s LTL revenue per hundredweight and LTL revenue per hundredweight, excluding fuel surcharges, jumped 4.2% and 4.7%, year over year, respectively.

Marty Freeman, the president and chief executive officer of Old Dominion, stated, “Our revenue results for May include increases in both our volumes and yield. We are pleased with the ongoing improvement in our LTL revenue per hundredweight, which reflects our consistent, cost-based approach to pricing as well as stability in the overall pricing environment. Our results continue to be supported by the consistent execution of our long-term strategic plan, which drives our ability to deliver superior service at a fair price to our customers.”

In the first quarter of 2024, revenues from LTL services came in at $1.45 billion, up 1.6% year over year. Revenues from other services fell 24.9% to $13.34 million. LTL weight per shipment declined 2.7%, and LTL revenue per shipment increased 1.3%. Each of LTL shipments and LTL shipments per day were down 0.5% on a year-over-year basis. LTL revenue per hundredweight increased 4.1%.

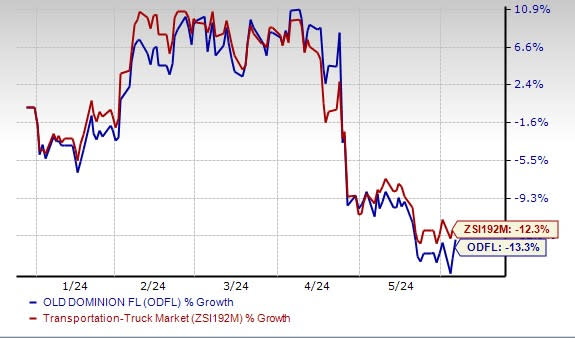

Mainly due to the weakness in the LTL services segment, shares of ODFL have declined 13.3% compared with its industry’s 12.3% fall.

Image Source: Zacks Investment Research

However, the improvement in the metrics for May is an upside for the stock.

Zacks Rank and Stocks to Consider

Currently, Old Dominion carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Transportation sector are Wabtec Corporation WAB and Kirby Corporation KEX.

WAB currently sports a Zacks Rank #1 (Strong Buy) and has an expected earnings growth rate of 22.6% for the current year. You can see the complete list of today’s Zacks #1 Rank stocks here.

WAB has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 11.5%. Shares of Wabtec have surged 69.5% in the past year.

KEX currently sports a Zacks Rank #1 and has an expected earnings growth rate of 42.2% for the current year.

The company has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in each of the trailing four quarters. The average beat is 10.3%. Shares of KEX have surged 60.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance