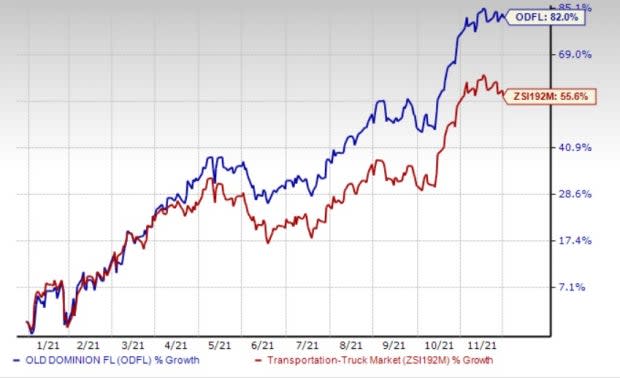

Old Dominion Freight Line (ODFL) Surges 82% YTD: Here's Why

Shares of Old Dominion Freight Line ODFL have been displaying an uptrend on the bourses year to date. The ODFL stock has surged 82% so far this year, outperforming its industry’s 55.6% growth.

Image Source: Zacks Investment Research

Let’s take a look at the factors that are working in favor of the stock.

Solid Rank: Old Dominion currently carries a Zacks Rank #2 (Buy). Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2 offer attractive investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: Upward estimate revisions raise optimism for a stock’s prospects. Old Dominion scores impressively on this front. The Zacks Consensus Estimate for fourth-quarter 2021 earnings has moved 3.7% north over the past 60 days to $2.22 per share. The same has increased 2.7% to $8.71 per share for the full year in the same time span.

Positive Earnings Surprise History: Old Dominion has an impressive earnings surprise history. The bottom line outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average being 5.2%.

Driving Factors: Old Dominion's efforts to add shareholder value are appreciative. ODFL shelled out $435.1 million to its shareholders in 2020. In the first nine months of 2021, ODFL paid out dividends of $69.4 million and repurchased shares worth $599 million. Improvement in the operating ratio (operating expenses as a % of revenues) owing to higher revenues is encouraging. With improved freight market conditions, a rise in LTL (Less-Than-Truckload) shipments is driving the top line.

Some other top-ranked stocks in the same industry are as follows:

ArcBest Corporation ARCB sports a Zacks Rank #1 at present. ARCB has a stellar surprise history, earnings of which outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 27.4%.

Shares of ArcBest have rallied more than 100% so far this year. Improving freight conditions in the United States bode well for ARCB. Solid customer demand and higher market rates are supporting growth at ARCB.

Knight-Swift Transportation Holdings KNX currently flaunts a Zacks Rank of 1. KNX’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 14%.

Shares of Knight-Swift have gained 37% so far this year. A strong performance of its logistics segment is aiding growth. Efforts to reward its shareholders also bode well.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

KnightSwift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

ArcBest Corporation (ARCB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance