Oil Prices May Have Found a Floor: 3 Top-Ranked Oil and Gas Stocks for the Next Rally

While the price of oil has fallen significantly since its high of $120 last summer, it still has several bullish catalysts that can ignite another bull run.

The fact of the matter is that a significant underinvestment into oil and gas infrastructure over the last ten years has created a structural shortage in new supply.

The trifecta of ESG, OPEC+ policy, and PTSD from the last energy cycle have been the primary factors limiting new production. With new infrastructure investments taking 3-5 years before yielding significant output, supply could be strained for several years going forward.

Fundamental Catalysts

ESG, which stands for environment, social, and corporate governance is a recent business framework popularizing the ideas of environmental and social consideration of business actions. While fundamentally a pragmatic and forward-thinking institution, it has distorted investment activity over the last few years.

Money that may have gone to oil and gas investments that were instead redirected to renewable energy efforts have unfortunately not been as fruitful as previously hoped. The stark reality of the situation is that most alternative energy efforts still have limited upside economic opportunity.

OPEC+ over the last few months has made it abundantly clear that they will be cutting production and defending the price of oil. Just last week the organization announced that they will be cutting daily production by 1 million barrels per day, which is in addition to already announced cuts from earlier this year.

The early 2000s were marked by tremendous growth rates, driven heavily by China. This booming international economy pushed demand for oil to new highs, and thus new highs for the price of oil. Energy companies excitedly reinvested $100s of billions of profits into new drilling, extraction, and pipelines to meet this new demand.

However, 2008 would hit like a ton of bricks, and slam the global economy to a near halt. Oil prices collapsed from $140 to $40 and suddenly, these new energy infrastructure investments were pointless. There was a huge correction in the energy industry and most companies didn’t survive.

This cycle traumatized a generation of energy investors and has left oil and gas companies understandably hoarding profits, rather than reinvesting. It didn’t help that the last decade demonized oil and gas, and vehemently encouraged investment in alternative energy sources.

The technical picture of oil prices defines a compelling structure, and path for oil prices going forward. After consolidating for more than a year, and putting in a double bottom in May, the chart is beginning to look conducive again for a move higher.

$74 remains a near-term level of resistance, and $82 a major level of resistance. Above those levels and it’s off to the races for oil.

Image Source: TradingView

Energy Companies

Instead of buying the commodity outright, investing in energy companies is another way to play this investment trend. The Zacks Rank #1 list has identified a number of compelling oil stocks to consider.

Sunoco SUN, Weatherford International WFRD, and Seadrill Limited SDRL are three stocks with upward trending earnings revisions. Additionally, these stocks represent three different industries within the sector, Refining and Marketing, Field Services, and Drilling offering investors a diversified way to gain exposure to the sector.

Sunoco is a well-established American energy company that operates in the downstream sector of the oil and gas industry. With a history dating back to 1886, Sunoco has a strong presence in various segments, including refining, distribution, and retail. The company operates a vast network of fuel distribution terminals, pipelines, and retail fuel stations across the United States.

Sunoco's refining segment focuses on processing crude oil into various petroleum products, including gasoline, diesel, and jet fuel. The distribution arm of the company transports and markets these refined products to wholesalers, retailers, and commercial customers.

Additionally, Sunoco operates a chain of convenience stores and retail fuel stations under its Sunoco brand, providing customers with a one-stop-shop for fuel, snacks, and other convenience items. With a commitment to customer service, operational excellence, and a strong brand presence, Sunoco continues to be a significant player in the energy sector, catering to the fuel needs of consumers and businesses alike.

SUN has sat on the Zacks Rank #1 list since January 2023, reflecting its consistently up trending earnings revisions. FY23 earnings have been revised higher by 6.5% over the last two months but are projected to decline -1.3% YoY.

Sunoco is trading at a one-year forward earnings multiple of 9.5x, which is just below the industry average of 9.9x, and well below its 10-year median of 13x. Additionally, SUN offers a generous dividend yield of 7.7%.

Image Source: Zacks Investment Research

Weatherford International provides oil field services and equipment. WFRD offers drilling solutions, gas well unloading, restoration and other related activities.

Although the company went public quite recently, in May 2021, WFRD stock has been an exceptional performer. Over that time, it is up 390%, far outperforming the industry and broad market.

Image Source: Zacks Investment Research

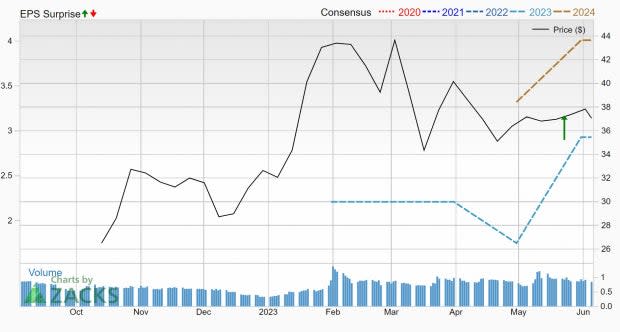

With consistent upgrades in its earnings estimates Weatherford International boasts a Zacks Rank #1 (Strong Buy). Current quarter earnings have been revised higher by 33% to $1.32 per share. In the same quarter a year ago, WFRD earned -$0.11 per share, so this is a huge YoY improvement.

Additionally, current quarter sales are expected to grow 16% YoY, while FY23 sales are expected to climb 15.3% YoY.

Image Source: Zacks Investment Research

Seadrill Limited specializes in offshore drilling operations. They own and operate a variety of drilling rigs, including drillships, semi-submersible rigs, and jack-up rigs. These rigs are used in both shallow and ultra-deep waters, and they can withstand different environmental conditions, ranging from calm to harsh environments.

Seadrill not only provides drilling services but also offers support and management services to other companies involved in the industry. As of April 8, 2022, they had a fleet of 21 offshore drilling units.

SDRL’s earnings revisions have been trending sharply higher, reflecting its Zacks Rank #1 (Strong Buy). Current quarter earnings have been revised higher by 104%, and next quarter earnings have been revised higher by 75%. Additionally, next quarter sales are expected to grow 50% YoY, while FY24 sales are projected to grow 17%.

Image Source: Zacks Investment Research

Bottom Line

The energy industry may seem to be in a rut now, but that doesn't mean it will stay that way. With the fundamental factors, and improving earnings expectations aligning, energy stocks may be the next sector to really pop off.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sunoco LP (SUN) : Free Stock Analysis Report

Seadrill Limited (SDRL) : Free Stock Analysis Report

Weatherford International PLC (WFRD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance