NZD/USD Outlook Mired by RSI Divergence; New Zealand CPI on Tap

DailyFX.com -

Talking Points:

- NZD/USD Outlook Mired by RSI Divergence; New Zealand CPI on Tap.

- USDOLLAR Remains Range-Bound Despite Strong Retail Sales, Rising Core Inflation.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

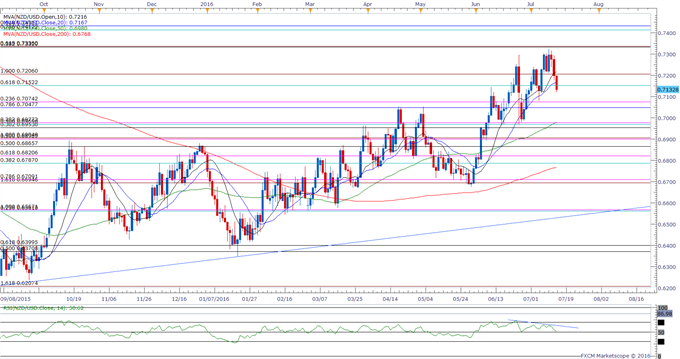

NZD/USD

Chart - Created Using FXCM Marketscope 2.0

NZD/USD stands at risk for a larger pullback amid the failed attempts to break above the Fibonacci overlap around 0.7330 (38.2% retracement) to 0.7340 (61.8% expansion), while a bearish divergence appears to be taking shape in the Relative Strength Index (RSI).

Despite market speculation for additional monetary support, the Reserve Bank of New Zealand (RBNZ) may continue to endorse a wait-and-see approach at the next policy meeting on August 11 as the 2Q Consumer Price Index (CPI) is expected to increase to an annualized rate of 0.5% from 0.4% to mark the fastest rate of growth since the last three-months of 2014.

Recent string of lower highs & lows may generate a bigger decline over the days ahead, with the first downside region of interest coming in around 0.7050 (78.6% retracement) to 0.7070 (23.6% expansion) followed by 0.6950 (38.2% retracement) to 0.6980 (38.2% expansion).

The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short NZD/USD since June 1, with the ratio hitting a near-term extreme earlier this month as it dipped to -2.25.

The ratio currently sits at -1.36 as 42% of traders are long, with short positions narrowing 29.0% from the previous week, while open interest stands 11.0% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

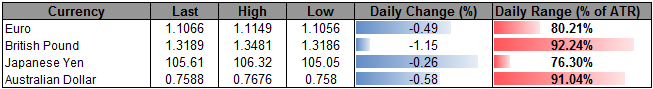

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12038.27 | 12041.37 | 11972.78 | 0.42 | 96.00% |

Chart - Created Using FXCM Marketscope 2.0

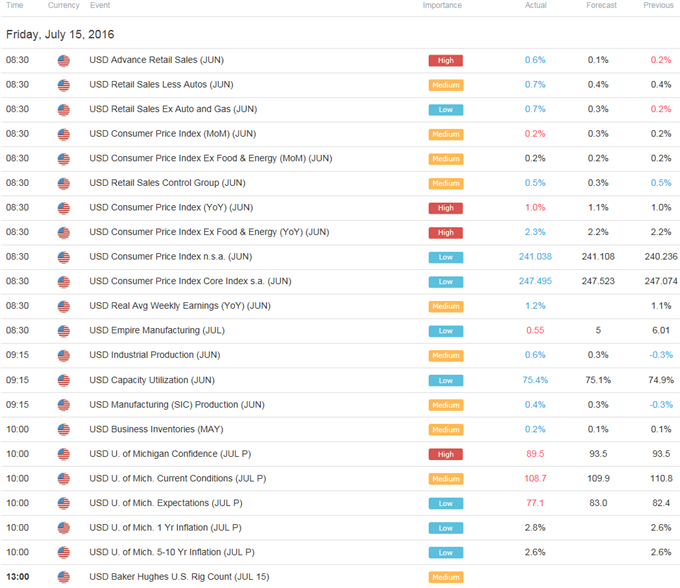

The USDOLLAR trades on a firmer footing following the pickup in U.S. Retail Sales accompanied by the unexpected uptick in the core Consumer Price Index (CPI), but the failure to break the monthly opening range may continue to foster choppy price action as market participants weigh the outlook for monetary policy.

Even though the U. of Michigan survey unexpectedly narrows in July, the uptick in 12-month inflation expectation may put increased pressure on the Federal Open Market Committee (FOMC) to raise the benchmark interest rate sooner rather than later as the central bank runs the risk of overshooting the 2% target for price growth.

Nevertheless, will continue to watch the near-term range in the USDOLLAR, with the index capped by 12,049 (78.6% retracement) to 12,064 (61.8% retracement), while support comes in around 11,951 (38.2% expansion) to 11,965 (23.6% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

Technical Focus: Copper Base Still a Work in Progress

Silver Prices: Spiral Higher Triggers Historical Momentum Readings

USD/CAD Technical Analysis: Looking Ready To Claw-Back H1 Losses

USD/JPY Technical Analysis: The Proverbial Falling Knife

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance