NZD Extends 2017 Rally Ahead of 4Q CPI; Bearish Outlook at Risk

DailyFX.com -

Talking Points:

- NZD/USD Extends 2017 Advance Ahead of NZ 4Q CPI; Bearish Outlook at Risk.

- USD/JPY Holds Near-Term Support; Nikkei 225 Highlights Similar Dynamic.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

NZD/USD | 0.7262 | 0.7277 | 0.7209 | 29 | 68 |

NZD/USD Daily

Chart - Created Using Trading View

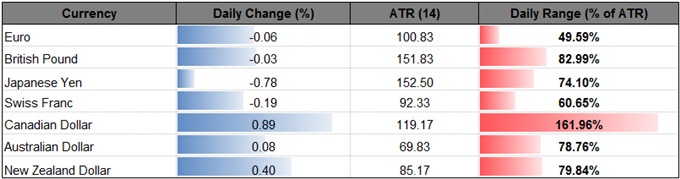

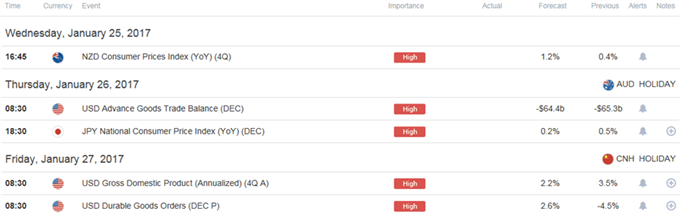

The New Zealand dollar extends the advance from earlier this month as a gauge for service-based activity hit a 12-month high in December, and the higher-yielding currency may continue to gain ground over the coming days as the region’s 4Q Consumer Price Index (CPI) is expected to increase an annualized 1.2% following the 0.4% expansion during the three-months through September; NZD/USD may continue to retrace the decline from the 2016-high (0.7484) as the pair appears to be breaking out of the downward trending channel carried over from the previous year, with the Relative Strength Index (RSI) clings onto bullish structure from the end of 2016 and highlights a similar dynamic.

With the headline reading for inflation projected to expand at the fastest pace since 2014, the Reserve Bank of New Zealand (RBNZ) may adopt a more hawkish tone at the February 9 interest rate decision as ‘annual inflation is expected to rise from the December quarter, reflecting the policy stimulus to date, the strength of the domestic economy, and reduced drag from tradables inflation;’ speculation for a shift in monetary policy may heighten the appeal of the kiwi, but Governor Graeme Wheeler may preserve the status quo and stick to the current script as ‘numerous uncertainties remain, particularly in respect of the international outlook, and policy may need to adjust accordingly.’

With the break of the December high (0.7239), topside targets are on the radar ahead of the New Zealand’s CPI print, with the next region of interest coming in around 0.7330 (38.2% retracement) to 0.7350 (61.8% expansion) followed by the November high (0.7403).

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

USD/JPY | 113.58 | 113.66 | 112.53 | 87 | 113 |

USD/JPY Daily

Chart - Created Using Trading View

USD/JPY may continue to operate within the descending channel carried over from December as it snaps back from a fresh weekly low of (112.51), with the failed attempt to break/close below near-term support around 112.40 (61.8% retracement) to 112.50 (38.2% retracement) raising the risk for a larger recovery; broader outlook remains constructive as a bull-flag still appears to be taking shape, and a pickup in risk sentiment may keep the exchange rate afloat as the Nikkei 225 follows a similar pattern.

Like the European Central Bank (ECB), the Bank of Japan (BoJ) may continue to endorse a dovish outlook for monetary policy and attempt to ward off a ‘taper tantrum’ as the central bank carries out the quantitative/qualitative easing (QQE) program with Yield-Curve Control, and more of the same from Governor Haruhiko Kuroda and Co. may keep market sentiment afloat as the central bank continues to expand its balance sheet.

The rebound in both USD/JPY and the Nikkei 225 may gather pace ahead of the BoJ & Fed interest rate decisions on tap for the week ahead as especially as the benchmark equity index fails to test the monthly low (18,638), with the first topside region of interest coming in around 114.00 (23.6% retracement) to 114.60 (23.6% expansion) followed by 116.10 (78.6% expansion) to 116.60 (38.2% expansion).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click HERE for the Entire DailyFX Webinar schedule.

The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long USD/JPYduring the last full-week of January, while traders remain net-short NZD/USD since January 12, with the last extreme reading seen back in November (-2.79).

USD/JPY SSI sits at +1.27 as 56% of traders are long, with short positions 11.9% higher from the previous week, while open interest stands 9.1% above the monthly average.

NZD/USD SSI sits at -1.72 as 37% of traders are long, with short positions 14.5% higher from the previous week, while open interest stands 5.2% above the monthly average.

The retail crowd appears to be fighting the near-term advance in NZD/USD as the SSI ratio pushes deeper into negative territory; may see retail position approach previous extremes should the near-term dynamics continue to take shape.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Click Here for the DailyFX Calendar

If you’re looking for trading ideas, check out our Trading Guides.

Read More:

S&P 500 Technical Analysis: Short-term Chart Pattern in View

Brexit Briefing: British Pound Gathers Strength, Supreme Court Vote Ahead

Silver Prices: Trading Levels in Play

Gold Off Key Resistance- Trump, US GDP to Determine Depth of Correction

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance