Nucor (NUE) Projects Lower Q2 Earnings Amid Weaker Steel Prices

Nucor Corporation NUE has announced its guidance for the second quarter of 2024. The company expects earnings between $2.20 per share and $2.30 per share. This compares unfavorably with $3.46 in the first quarter of 2024 and $5.81 in the second quarter of 2023.

The primary factor behind the anticipated decrease is reduced earnings in the steel mills segment, mainly due to lower average selling prices and, to a lesser extent, lower volumes. The steel products segment is also expected to see decreased earnings compared with the first quarter, due to lower average selling prices, though this will be partially offset by increased volumes. Earnings in the raw materials segment are projected to be higher compared with the first quarter, thanks to increased profitability at Nucor's direct reduced iron facilities.

In the second quarter, Nucor repurchased approximately 2.9 million shares at an average price of $170.70 per share, bringing the year-to-date total to around 8.5 million shares repurchased at an average price of $177.30 per share. So far, in 2024, it has returned more than $1.76 billion to stockholders through share repurchases and dividend payments.

Shares of the company have gained 2.2% in a year against the industry’s 2.1% decline.

Image Source: Zacks Investment Research

Nucor reported first-quarter 2024 earnings of $3.46 per share, which declined from $4.45 in the year-ago quarter, missing the Zacks Consensus Estimate of $3.62. The company reported net sales of $8,137.1 million, down approximately 7% year over year but surpassing the Zacks Consensus Estimate of $8,030.1 million.

Total steel mills sales to outside customers were 4,676,000 tons, down 3% year over year. The average sales price for steel mills was $1,108 per ton. Operating rates improved to 82% in the first quarter of 2024 from 79% in the same period last year.

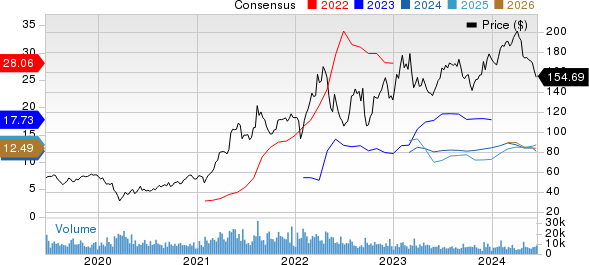

Nucor Corporation Price and Consensus

Nucor Corporation price-consensus-chart | Nucor Corporation Quote

Zacks Rank & Key Picks

Nucor currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, ATI Inc. ATI and Ecolab Inc. ECL. While Carpenter Technology sports a Zacks Rank #1 (Strong Buy) at present, ATI and Ecolab carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRS’s current-year earnings is pegged at $4.31, indicating a year-over-year rise of 278%. CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, the average earnings surprise being 15.1%. The company’s shares have soared 86.9% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 8.34%, on average. The stock has rallied 35.8% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a rise of 26.5% from the year-ago levels. ECL beat the consensus estimate in each of the last four quarters, the average earnings surprise being 1.3. The stock has rallied nearly 31.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance