Is Now The Time To Put Yellow Cake (LON:YCA) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Yellow Cake (LON:YCA), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Yellow Cake

How Fast Is Yellow Cake Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Yellow Cake to have grown EPS from US$0.34 to US$2.28 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

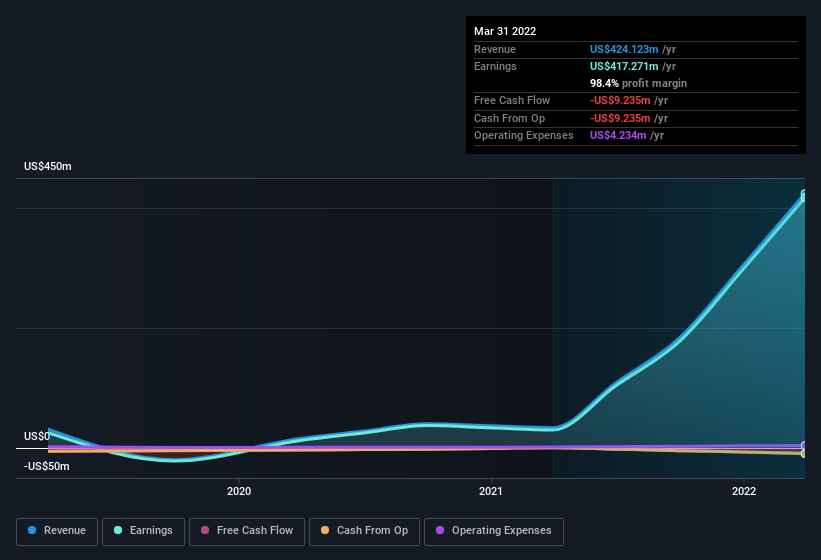

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Yellow Cake's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Yellow Cake is growing revenues, and EBIT margins improved by 8.2 percentage points to 98%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Yellow Cake Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Yellow Cake shares worth a considerable sum. Indeed, they hold US$22m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 3.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Yellow Cake with market caps between US$400m and US$1.6b is about US$1.4m.

The CEO of Yellow Cake only received US$356k in total compensation for the year ending March 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Yellow Cake Worth Keeping An Eye On?

Yellow Cake's earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Yellow Cake is worth considering carefully. We should say that we've discovered 3 warning signs for Yellow Cake (2 are significant!) that you should be aware of before investing here.

Although Yellow Cake certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance