Is Now The Time To Put Microequities Asset Management Group (ASX:MAM) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Microequities Asset Management Group (ASX:MAM), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Microequities Asset Management Group

Microequities Asset Management Group's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Microequities Asset Management Group grew its EPS from AU$0.047 to AU$0.17, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Microequities Asset Management Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Microequities Asset Management Group is growing revenues, and EBIT margins improved by 13.7 percentage points to 89%, over the last year. Both of which are great metrics to check off for potential growth.

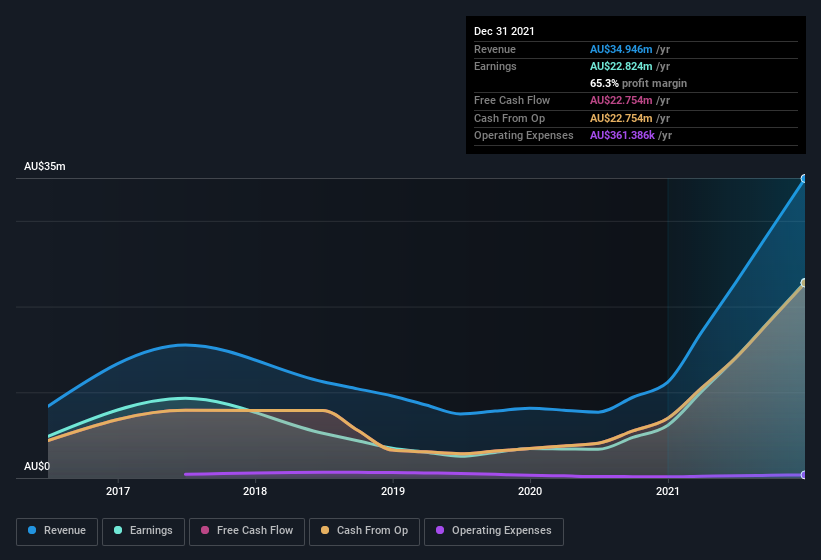

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Microequities Asset Management Group is no giant, with a market capitalisation of AU$93m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Microequities Asset Management Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first, there weren't any reports of insiders selling shares in Microequities Asset Management Group in the last 12 months. But the important part is that Independent Non Executive Director Alexander Abrahams spent AU$368k buying stock, at an average price of AU$0.86. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Microequities Asset Management Group insiders own more than a third of the company. In fact, they own 75% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at AU$70m at the current share price. That's nothing to sneeze at!

Should You Add Microequities Asset Management Group To Your Watchlist?

Microequities Asset Management Group's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Microequities Asset Management Group belongs near the top of your watchlist. Before you take the next step you should know about the 2 warning signs for Microequities Asset Management Group that we have uncovered.

The good news is that Microequities Asset Management Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance