Is Now The Time To Put FMC (NYSE:FMC) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in FMC (NYSE:FMC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for FMC

FMC's Improving Profits

In the last three years FMC's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. FMC has grown its trailing twelve month EPS from US$4.23 to US$4.49, in the last year. That's a modest gain of 6.1%.

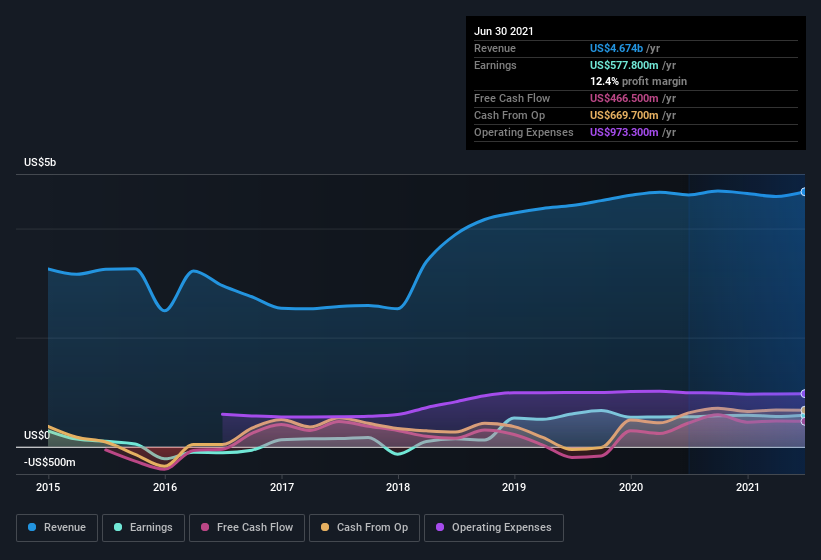

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. FMC reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for FMC.

Are FMC Insiders Aligned With All Shareholders?

Since FMC has a market capitalization of US$12b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Given insiders own a small fortune of shares, currently valued at US$54m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like FMC, with market caps over US$8.0b, is about US$11m.

The FMC CEO received US$5.9m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does FMC Deserve A Spot On Your Watchlist?

One important encouraging feature of FMC is that it is growing profits. Earnings growth might be the main game for FMC, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Still, you should learn about the 1 warning sign we've spotted with FMC .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance