Is Now The Time To Put Eclipx Group (ASX:ECX) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Eclipx Group (ASX:ECX), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Eclipx Group with the means to add long-term value to shareholders.

View our latest analysis for Eclipx Group

How Fast Is Eclipx Group Growing Its Earnings Per Share?

Eclipx Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Eclipx Group's EPS shot from AU$0.16 to AU$0.32, over the last year. It's not often a company can achieve year-on-year growth of 101%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. This approach makes Eclipx Group look pretty good, on balance; although revenue is flattish, EBIT margins improved from 13% to 23% in the last year. That's something to smile about.

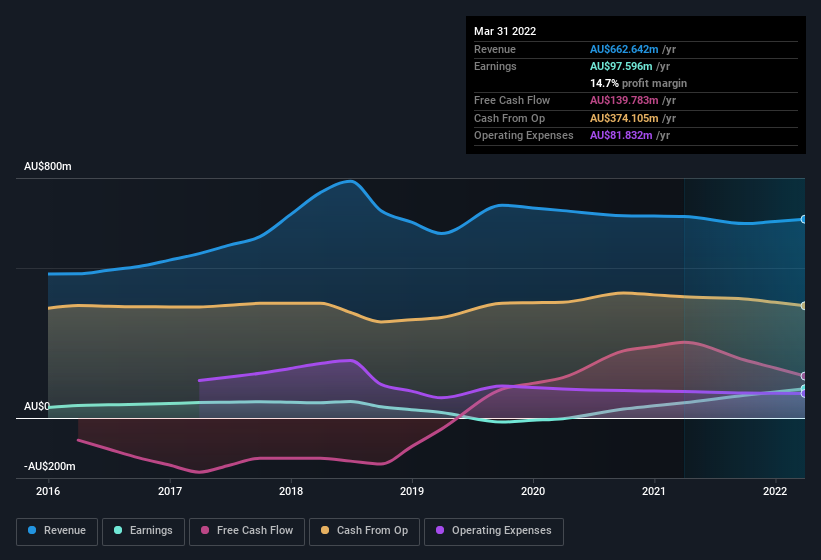

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Eclipx Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Eclipx Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Eclipx Group shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Independent Non-Executive Director Cathy Yuncken bought AU$20k worth of shares at an average price of around AU$2.48. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Does Eclipx Group Deserve A Spot On Your Watchlist?

Eclipx Group's earnings per share have been soaring, with growth rates sky high. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Eclipx Group on your watchlist. Even so, be aware that Eclipx Group is showing 2 warning signs in our investment analysis , and 1 of those is significant...

The good news is that Eclipx Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance