Is Now The Time To Put Cryosite (ASX:CTE) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Cryosite (ASX:CTE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Cryosite

How Quickly Is Cryosite Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Cryosite has achieved impressive annual EPS growth of 44%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

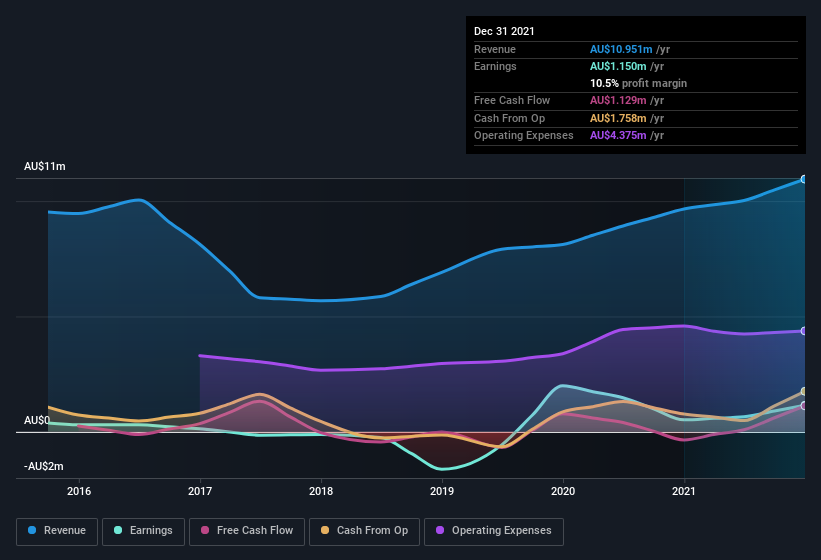

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Cryosite shareholders can take confidence from the fact that EBIT margins are up from 8.7% to 14%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Cryosite is no giant, with a market capitalisation of AU$33m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Cryosite Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First and foremost; there we saw no insiders sell Cryosite shares in the last year. But the important part is that Non Executive Director Andrew Kroger spent AU$992k buying stock, at an average price of AU$0.44. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Cryosite will reveal that insiders own a significant piece of the pie. Owning 50% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Although, with Cryosite being valued at AU$33m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to AU$16m. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Cryosite's CEO, John Hogg, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under AU$288m, like Cryosite, the median CEO pay is around AU$410k.

Cryosite offered total compensation worth AU$337k to its CEO in the year to June 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Cryosite Deserve A Spot On Your Watchlist?

Cryosite's earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Cryosite deserves timely attention. Even so, be aware that Cryosite is showing 2 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Cryosite, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance