‘Now is the time to buy’: Property experts' rent warning

Australians in all capital cities, bar Sydney and Melbourne, would be better off buying a home than renting it, new data has revealed.

According to Pete Wargent, co-founder of online buyers’ agency marketplace BuyersBuyers.com.au, it’s more compelling to purchase, rather than rent, a home in most states for Aussies with access to a deposit and a reasonable level of employment security.

And in many areas, rent money really is dead money, added RiskWise CEO Doron Peleg.

“When it comes to houses, the preferred dwelling option in most areas of the country, in many cases it is cheaper to buy than rent,” Peleg said.

“If you buy a house you can start building equity straight away, particularly when you take a long-term strategic view, and if you are in a good position to negotiate well and buy a ‘Grade A’ property that will serve your family for many years to come.”

Also read: The 'unfortunate' property trend forced by Covid-19

Also read: Why off-the-plan apartments are riskier than ever

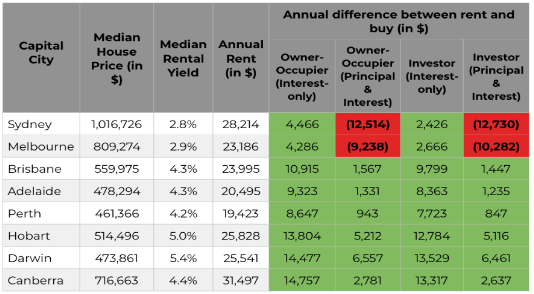

RiskWise research found that interest-only repayments for both owner-occupiers and investors are lower than the annual rental cost in most areas.

What’s more, in all states and territories except for Sydney and Melbourne, even the principal and interest repayments are lower than the annual rent – that’s assuming that you have a 20 per cent deposit.

In Sydney, annual rent on the median house price costs nearly $30,000. That’s $4,466 more than it costs to pay the interest-only repayments. However, it costs $12,514 more to service the principal and interest payments, with renting the more affordable option.

In Adelaide however, annual rent on the median house price is around $20,500. That’s nearly $10,000 more than it costs to pay the interest-only repayments, and $1,567 more than it costs to service principal and interest payments.

It’s the same case in Perth, Hobart, Darwin, Canberra and Brisbane, where annual rent is thousands more expensive than servicing principal and interest repayments on a mortgage.

Interest rates at record low

It’s no surprise it’s become more affordable to buy property than rent, given interest rates are at a record low of 0.25 per cent.

“Ultra-low interest rates means some lenders have even begun to offer introductory variable home loan rates of 1.99 per cent, and we’ve already seen the first fixed rate of less than 2 per cent,” Wargent said.

But this is only temporary, with RiskWise chief Peleg warning that, if you’re a first home-buyer, “now is the time to buy”.

“This current slowdown in the property market is only temporary, with houses in popular areas likely to experience solid capital growth in the medium to long term,” he said.

“Once the Covid-19 issue fades, most likely in 2021, the traditional connection between low interest rates and an increase in dwelling prices is likely to reassert itself.”

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!

Yahoo Finance

Yahoo Finance