Not Many Are Piling Into SelfWealth Limited (ASX:SWF) Just Yet

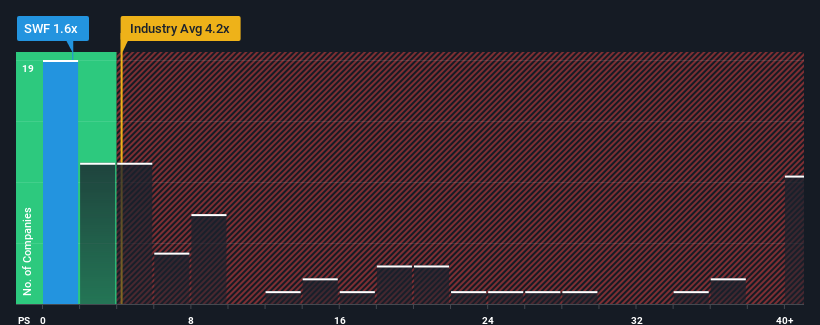

SelfWealth Limited's (ASX:SWF) price-to-sales (or "P/S") ratio of 1.6x might make it look like a strong buy right now compared to the Capital Markets industry in Australia, where around half of the companies have P/S ratios above 4.2x and even P/S above 21x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for SelfWealth

What Does SelfWealth's Recent Performance Look Like?

The revenue growth achieved at SelfWealth over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SelfWealth will help you shine a light on its historical performance.

Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, SelfWealth would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.9% shows it's a great look while it lasts.

With this information, we find it very odd that SelfWealth is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On SelfWealth's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of SelfWealth revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

We don't want to rain on the parade too much, but we did also find 1 warning sign for SelfWealth that you need to be mindful of.

If you're unsure about the strength of SelfWealth's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance