NortonLifeLock's (NLOK) HSR Waiting Period for Avast Buyout Ends

NortonLifeLock’s NLOK deal to acquire the London-listed rival, Avast Plc, took a step forward with an important regulatory approval from the U.S. Federal Trade Commission. The provider of consumer security software and solutions, NortonLifeLock, announced yesterday that the waiting period for a review of the transaction under the Hart-Scott-Rodino (“HSR”) Act has expired on Nov 12.

The HSR Act seeks to ensure due filing of all the documents necessary for mergers, acquisitions and transfer of assets or securities by companies with the U.S. Federal Trade Commission and Department of Justice.

The transaction is now required to fulfill certain terms and conditions prescribed by the U.K. court on Oct 28, 2021. The two companies expect to complete the deal in mid-2022.

U.S.-based NortonLifeLock and U.K.-based Avast Plc reached a merger agreement on Aug 10, under which the former agreed to acquire the latter in a cash-and-stock deal. The merger agreement values Avast’s entire ordinary share capital between $8.1 billion and $8.6 billion, depending upon its shareholders’ elections.

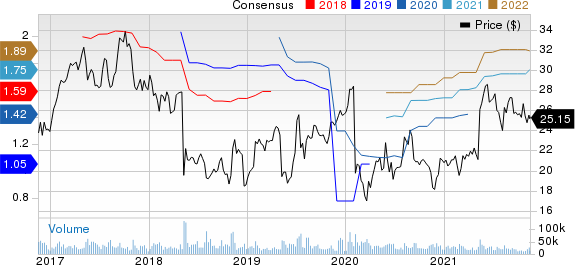

NortonLifeLock Inc. Price and Consensus

NortonLifeLock Inc. price-consensus-chart | NortonLifeLock Inc. Quote

Rationale Behind the Acquisition

The merger will combine two broad and complementary product portfolios, thereby helping NortonLifeLock in becoming a global leader in the consumer security software market. Avast makes free and premium security software for desktop and mobile devices, while NortonLifeLock primarily deals with consumer cyber safety.

The acquisition of Avast will help NortonLifeLock enhance its product portfolio and customer base. The U.S.-cybersecurity firm believes this combination will untie their complementary product portfolio strength for more than 500 million users.

The merger will strengthen geographical diversification and will likely help NortonLifeLock expand its presence in the Small Offices/Home Offices cyber security and very small businesses markets.

NLOK believes the combination would be accretive to its top-and bottom-line growth. It projects that the acquisition will drive double-digit growth in earnings per share within the first full year, following the completion of the transaction and double-digit growth in revenues over the long run.

The acquisition is also anticipated to strengthen the financial profile of the combined entity through cost synergies, increased scale, long-term growth and strong flow generation. NortonLifeLock estimates that the merger will create approximately $280 million of annual cost synergies.

NortonLifeLock Riding on Solid Cybersecurity Demand

NortonLifeLock is witnessing solid adoption of its cybersecurity and information backup solutions due to the surge in hacking events and data breaches globally.

Per an International Data Corporation report, worldwide security spending is expected to reach $174.7 billion in 2024, reflecting a CAGR of 8.1% from 2020-2024. NortonLifeLock is poised to benefit from an increase in security spending by enterprises.

Additionally, the company launched solutions such as Norton 360 for Gamers, which promotes cybersecurity in the gaming space and Norton 360 with LifeLock for family, an all-in-one protection plan to help protect the whole family’s identity, devices and online privacy. It has also expanded its privacy offering by introducing Privacy Monitor Assistant, which helps customers reclaim control over their personal information.

The new capabilities are likely to drive innovation in the company’s product portfolio as well as bolster user acquisition and engagement on its platform, thereby aiding the top line.

Zacks Rank & Stocks to Consider

NortonLifeLock currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader technology sector include Advanced Micro Devices AMD, Qualcomm QCOM and TD SYNNEX SNX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Advanced Micro Devices’ fourth-quarter 2021 earnings has been revised upward by 8 cents to 76 cents per share over the past 30 days. For 2021, earnings estimates have been moved upward by 15 cents to $2.65 per share in the last 30 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 14%. Shares of the AMD stock have rallied 59.7% in the year-to-date (“YTD”) period.

The consensus mark for Qualcomm’s first-quarter fiscal 2022 earnings has been raised to $3 per share from $2.63 per share 30 days ago. For fiscal 2022, earnings estimates have been revised upward by 11 cents to $10.51 per share in the last seven days.

Qualcomm’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 11.2%. Shares of the QCOM stock have gained 10.6% YTD.

TD SYNNEX’s consensus estimate for fourth-quarter fiscal 2021 earnings has been revised upward by 11.7% to $2.67 per share over the past 60 days. For fiscal 2021, earnings estimates have been moved upward by 6.5% to $8.95 per share over the last 60 days.

TD SYNNEX’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 15.4%. Shares of the SNX stock have rallied 38.1% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

TD SYNNEX Corp. (SNX) : Free Stock Analysis Report

NortonLifeLock Inc. (NLOK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance